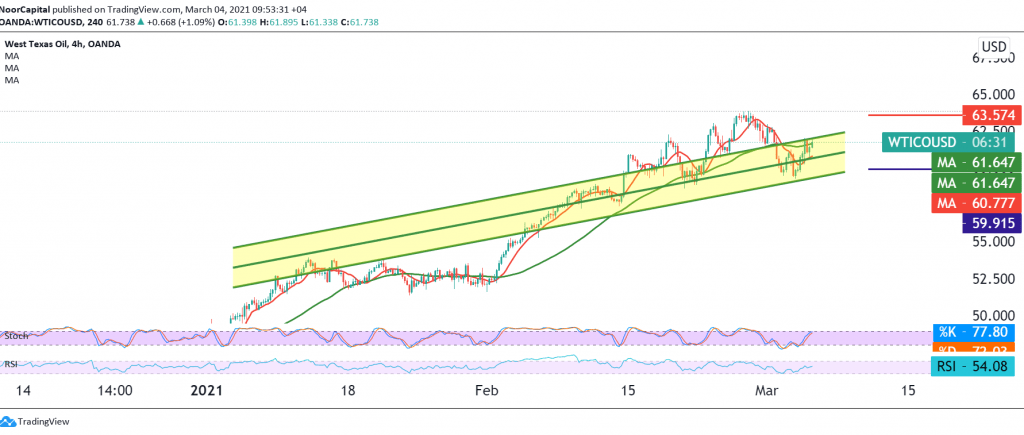

Positive trades dominated the US crude oil futures price after it found a solid support level near our awaited target of 59.10, recording a low of 59.25, to return to the bullish rebound again, and to remind us that the attempt to stabilize above 61.20 is a catalyst to enhance the chances of the upside towards 62.00.

Technically, oil starts its daily trading on a positive note, benefiting from stability above 61.10, accompanied by positive signals coming from the RSI on short time intervals.

Therefore, the bullish bias is likely today, targeting 62.70 a first target, and its breach is a catalyst that enhances the bullish chances to visit 63.50 a next stop.

Only from below is the confirmation of a break of 61.00/59.90 will stop the bullish scenario, and we will witness a bearish bias, targeting 58.20.

| S1: 59.90 | R1: 62.70 |

| S2: 58.20 | R2: 63.70 |

| S3: 57.20 | R3: 65.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations