US crude oil futures extended their recent rally, posting additional gains at the start of the week and reaching a session high of $65.62 per barrel.

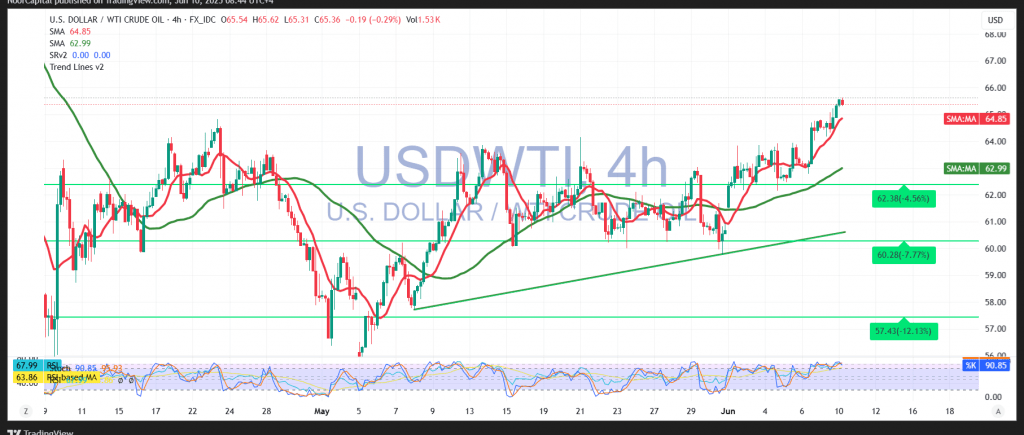

From a technical standpoint, despite heightened intraday volatility following the recent surge, the broader trend remains bullish. A closer inspection of the 4-hour chart reveals that the 50-day simple moving average continues to act as a dynamic support zone, currently aligned around $63.60. Meanwhile, the Relative Strength Index (RSI) has exited overbought territory and is showing signs of renewed momentum, suggesting further upside potential.

With daily trading holding above key support levels, the path of least resistance appears upward. The next immediate target lies at $65.90. A confirmed breakout above this level would strengthen bullish momentum, paving the way for a potential move toward $66.45.

Warning: Volatility remains elevated due to ongoing global trade tensions. Market conditions may shift quickly, and traders should remain cautious, as all scenarios remain on the table.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations