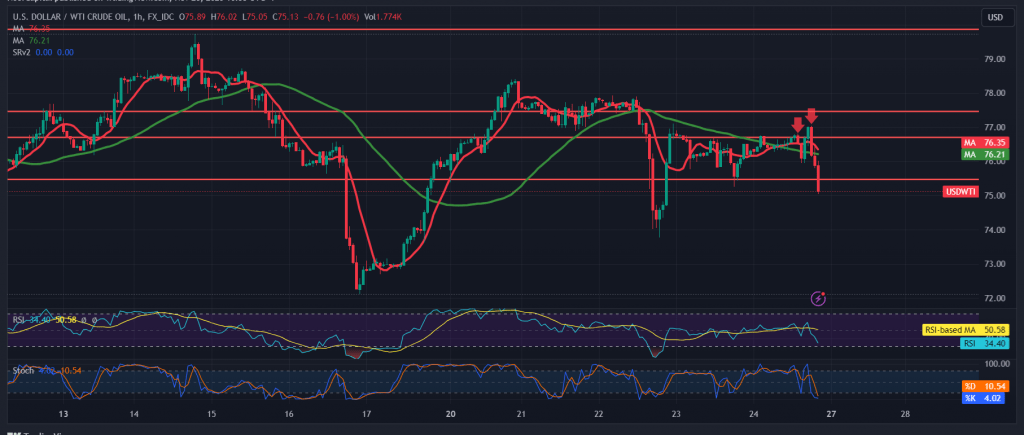

US crude oil futures prices experienced a significant decline last Friday, reaching the initial official target outlined in the preceding report at $75.75 and recording their lowest point at $75.13 per barrel.

From a technical perspective, the prevailing downward trend persists, with trading consolidating below the 76.40 resistance level. This level aligns with the 50-day simple moving average, reinforcing its significance and adding strength to the bearish momentum.

As a result, there is continued support for our negative outlook, maintaining the trajectory towards the remaining targets from the previous analysis: 74.75 and 74.50 serve as preliminary targets, and breaching the latter level would extend oil prices’ losses to the official station at 73.80.

On the upside, the re-establishment of trading stability above 76.40 would defer the prospects of a decline, redirecting oil prices to retest 77.70.

Note: The risk level may be high.

Note: Continued geopolitical tensions may contribute to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations