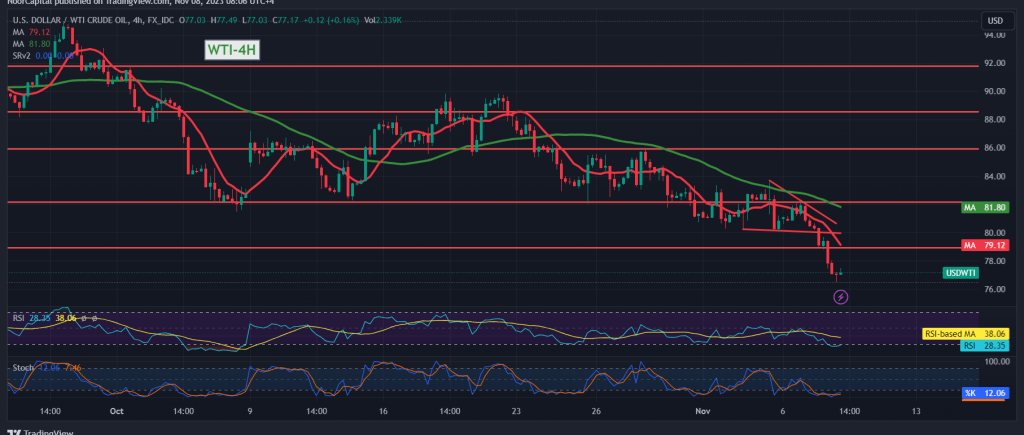

US crude oil futures prices continue to suffer losses as we expected, exceeding the last official stop required to be touched during the previous technical report at a price of 78.00, recording its lowest level of $76.57 per barrel during early trading of the current session.

Technically, with a closer look at the 240-minute time frame chart, we notice the continuation of the negative intersection of the simple moving averages, and oil prices have stabilized without resisting the psychological barrier of 79.00.

Therefore, the bearish scenario remains the most preferable, targeting 75.50 as the first target, and breaking it will extend oil’s losses, as we await 73.80, the next target.

Only from above, jumping upwards and the price consolidating above 79.00 postpones the chances of a decline, but does not cancel them, and we witness a retest of 80.00 before determining the next price destination.

The risks are high.

Warning: Today we are awaiting high-impact press talks, “Federal Reserve Governor Jerome Powell’s talk” and “BoE Governor’s talk,” and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations