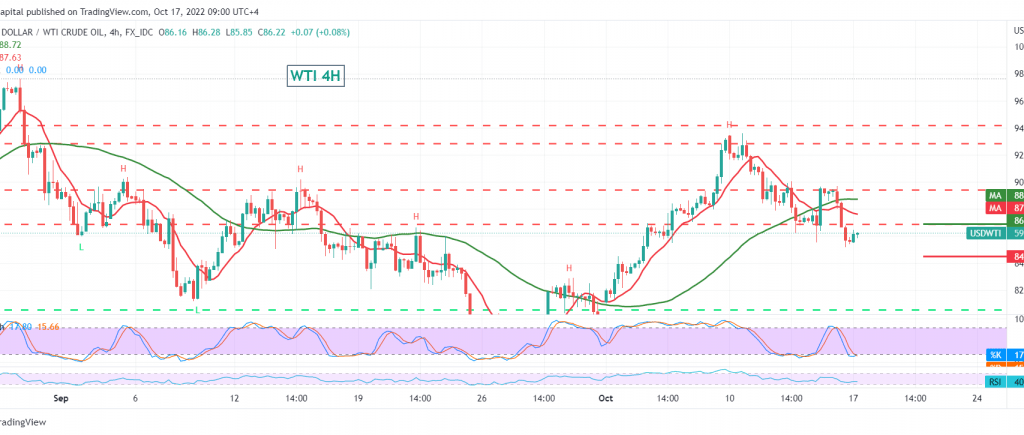

US crude oil futures prices declined, nullifying the expected bullish context during the last analysis, in which we depended on the stability of daily trading above 86.65.

Technically, and by looking at the 240-minute chart, we find the stability of the intraday trading below 87.00 that supports the decline, in addition to the negative pressure coming from the 50-day simple moving average, accompanied by the decrease of the momentum on the short time frames.

From here and steadily trading below 87.00, the bearish trend is the most preferred, targeting 84.40 the first target, and breaking it increases and accelerates the strength of the bearish trend, opening the way directly to visit 82.60.

Only from the top can we skip up and rise again above 87.10, with the closing of an hourly candle capable of temporarily turning the path to the upside, to retest 88.85.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations