U.S. crude oil futures are trading with a negative bias, despite brief intraday attempts to stabilize. The price is currently hovering near $61.20 per barrel, reflecting continued selling pressure.

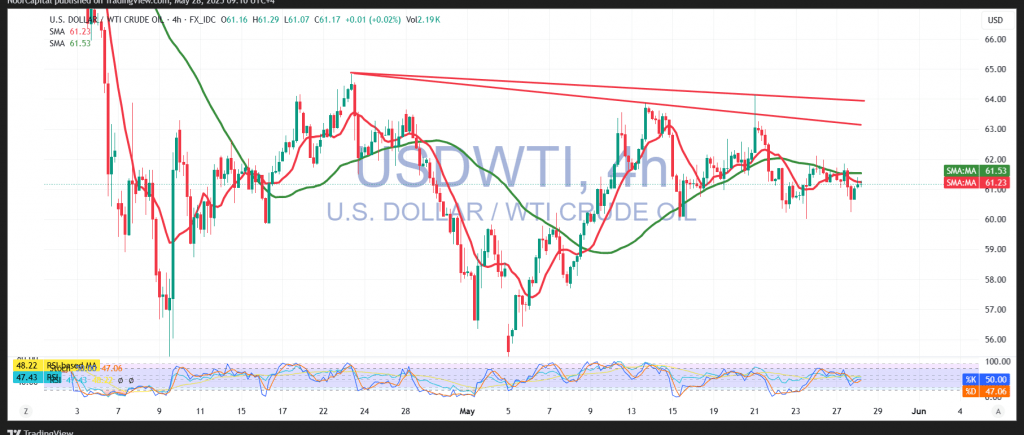

From a technical perspective, oil prices remain below the 50-day simple moving average, which acts as a key dynamic resistance at $61.55. Furthermore, the market continues to trade outside the ascending price channel, following a decisive break below its key support during the previous session—confirming a shift in momentum to the downside.

As long as intraday trading remains below $61.50—and more broadly below $61.90—the outlook favors a resumption of the downtrend. The immediate target is $60.40, with a break below this level likely accelerating losses toward $59.60.

Conversely, a sustained break and consolidation above $61.90 would be required to negate the current bearish setup and shift the outlook back toward neutral.

Key Event Risk Today:

Traders should be prepared for high volatility following the release of the Federal Reserve meeting minutes, a pivotal event that could significantly influence market sentiment.

Risk Disclaimer:

Amid global trade tensions and macroeconomic uncertainty, risk levels remain elevated. Traders should remain cautious and prepared for sharp price movements in either direction.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations