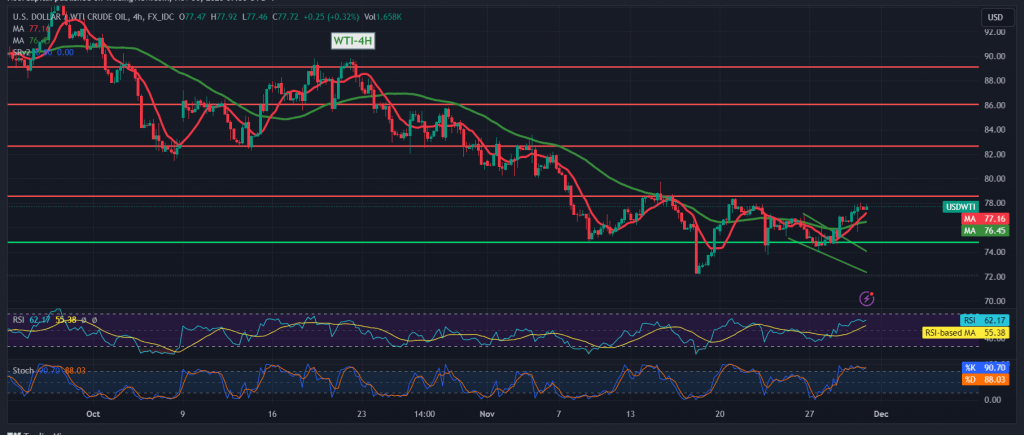

Positive momentum has taken control of US crude oil futures, defying the previously anticipated negative outlook. The emphasis was on stability below the resistance level of 77.80, with a clear indication that surpassing this level would thwart the bearish scenario. This prediction materialized as oil prices rose above 77.80, reaching a peak at 78.05.

Upon closer examination of the 4-hour chart, it is evident that the price has regained stability above the simple moving averages, signaling a potential upward movement. This aligns with the positive indications from the 14-day momentum indicator.

As long as intraday trading remains above 76.30, the possibility of an upward trend during today’s session exists. Breaching the psychological barrier at 78.00 would further strengthen the upward momentum, setting the stage for a target of 78.60 and subsequently 79.40.

However, it is crucial to note that dropping below 76.60 would immediately negate the proposed scenario, redirecting oil prices to the officially outlined downward trajectory. Targets for this downward movement start at 74.80 and then 73.80, marking the official station.

Caution: Today, high-impact economic data is expected from the US, particularly the annual “Core Personal Consumer Expenditure Price Index.” Increased volatility is likely upon the release of this news.

Caution: Risk levels may be elevated.

Caution: The overall risk remains high, given the ongoing geopolitical tensions, possibly contributing to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations