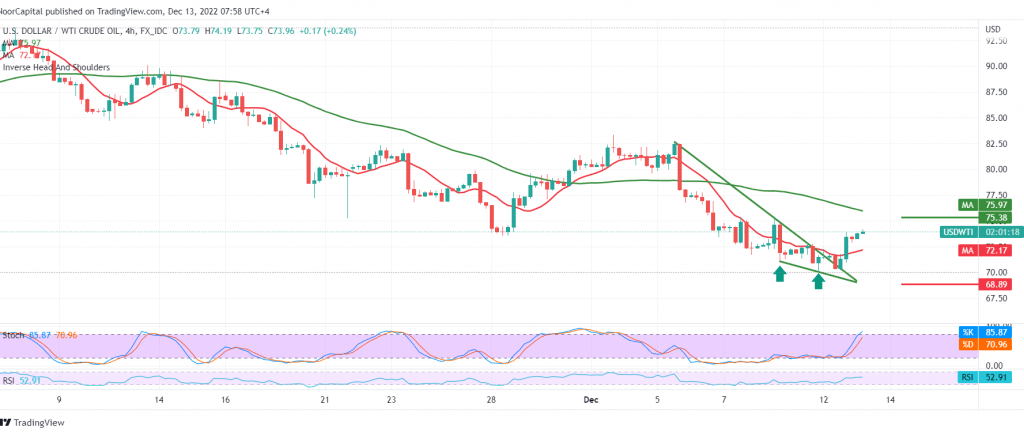

US crude oil futures prices jumped to achieve the required intraday rise during the previous analysis within retesting 72.50, to reverse the expected bearish trend yesterday, recording a high of 74.20 during the early trading of the current session.

On the technical side today, the simple moving averages are still an obstacle in front of the price, and we find the stochastic indicator around the overbought stage, but there are positive momentum signs coming from the relative strength index, which succeeded in settling above the midline 50.

Despite the conflicting technical signs, we tend towards intraday positivity, but with caution, relying on trading remaining above 71.50, and oil may target retesting 75.00 and 75.30, respectively, as long as trading remains stable above 71.50.

We remind you that the infiltration below 71.50 will immediately stop any attempts to rise and lead oil to the main bearish track, to be waiting for 70.00, and then 69.00 waiting stations.

Today we are awaiting high-impact economic data, and we may witness fluctuations at the time of news release:-

- The consumer price index from the United States of America is one of the most important measures of inflation and has an impact on the interest rate decision.

– Change in unemployment benefits from the UK, Bank of England Governor’s Speech.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations