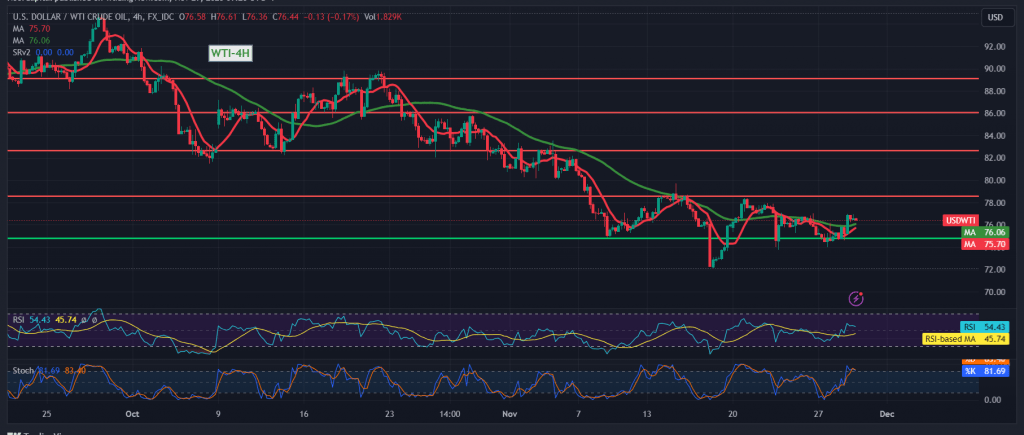

US crude oil futures witnessed mixed trading as they attempted to rise, yet these efforts remain limited, and the price remains stable below the resistance level at 77.80.

Examining the 4-hour chart, negative features are evident on the Stochastic indicator, gradually losing its upward momentum. This aligns with the continued formation of simple moving averages, exerting negative pressure on the price from above.

In this context, as long as intraday trading remains stable below the resistance at 77.80, it reinforces our negative expectations, targeting 75.15 as the awaited station. It’s crucial to closely monitor this level, as its breach would intensify the downward trend, paving the way directly towards 73.80.

On the contrary, a breakout above 77.80 has the potential to invalidate the proposed scenario, allowing oil prices to recover and visit 78.30 and 79.30, respectively.

Caution is warranted, given the potentially high risk level. The ongoing geopolitical tensions may contribute to increased price volatility. Traders should exercise vigilance and stay informed about key levels for potential market shifts.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations