Negative trading dominated the performance of US crude oil yesterday, within the expected bearish path, approaching by a few points from the published target of 84.40, recording its lowest level at 84.60.

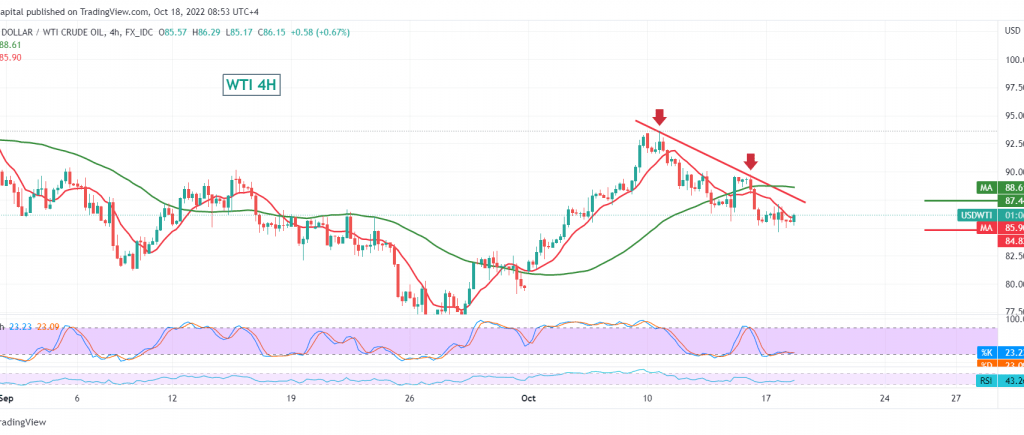

Technically, we notice that the simple moving averages continue to support the bearish scenario and the bearish technical structure shown on the 4-hour time frame.

From here, and with daily trading remaining below 86.80, it makes us maintain our negative outlook, knowing that the decline below 85.80 increases the strength of the daily bearish trend, so we are waiting for 84.80, a first target, and the negative targets extend to visit 83.50.

Consolidation above 86.80 can thwart the proposed scenario completely, and oil prices will start to present a positive session, with an initial target of 87.30.

Note: The risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations