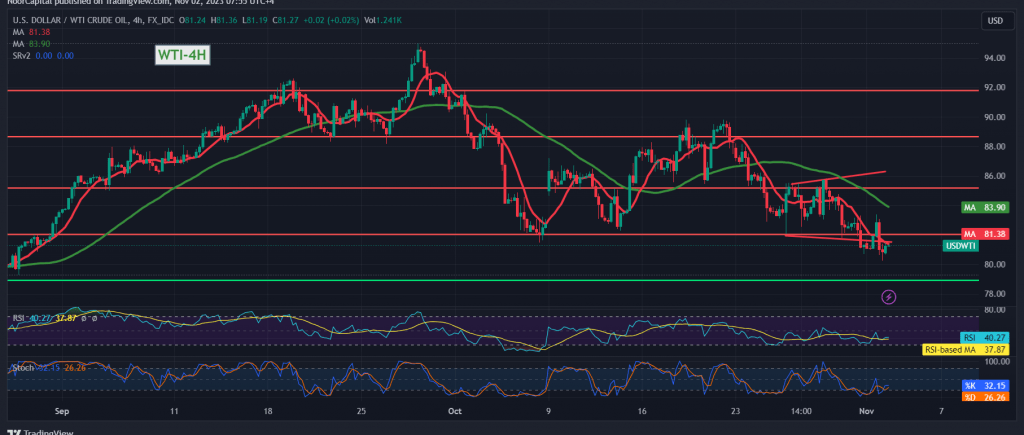

During the previous trading session, US crude oil futures exhibited mixed movements amid varied trading patterns. The prices briefly touched the stop losses mentioned in the previous report at $82.70, reaching a peak at $83.40. However, this level acted as a robust resistance, prompting a decline and causing oil to reach its lowest point at $80.85 per barrel.

From a technical perspective, the inclination is towards negativity, emphasizing the significance of intraday trading remaining below the resistance levels of $82.00 and, more crucially, $82.35. Additionally, the continued formation of simple moving averages exerts downward pressure on the price from above.

As a result, the bearish scenario is deemed the most favorable, with the initial target set at $80.30. It’s essential to exercise caution because breaching this level could extend oil’s losses, opening the path directly towards $79.30.

Conversely, a breakout above and consolidating the price beyond $82.35 could disrupt the proposed scenario. In such a case, the oil price might experience a recovery, aiming to retest $82.85 and then $84.30. Vigilant monitoring of these levels is crucial for traders and investors navigating the oil market.

Please be aware that today, there is anticipation of high-impact economic data originating from the British economy, including the Bank of England Governor’s speech, the interest rate decision, the monetary policy summary, the monetary policy report released by the Bank of England, and the Monetary Policy Committee’s vote on interest rates.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations