Negative pressure continues to dominate U.S. crude oil futures, with prices reaching a low of $72.95 per barrel during the previous session.

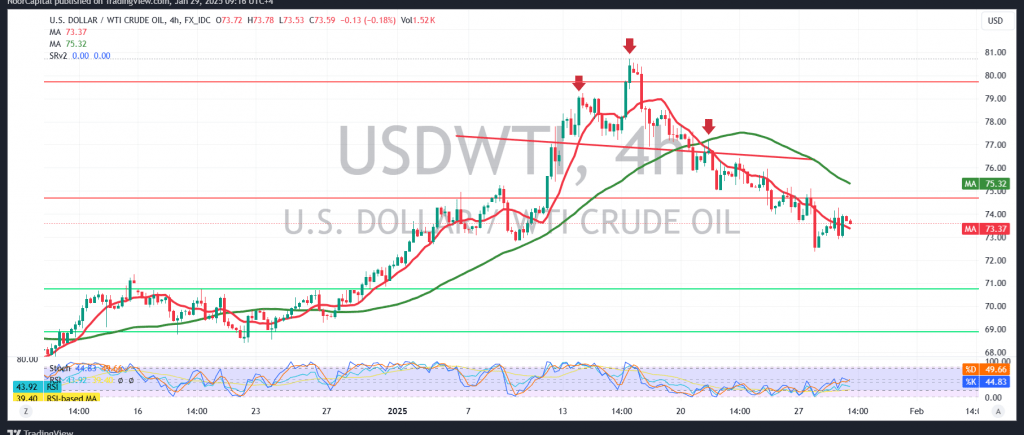

From a technical perspective, the 4-hour chart reveals a bearish head and shoulders formation, with the price remaining below 74.25, further pressured by negative signals from the simple moving averages.

As a result, the bearish trend may remain in effect, with the next key target at 72.30, unless a rebound above 74.25 occurs.

On the upside, stabilizing above 74.25 could temporarily disrupt the bearish outlook, potentially paving the way for a recovery toward 75.00.

Caution: Today, the market awaits high-impact economic data from the U.S., including the Federal Reserve statement, Fed Chair press conference, and interest rate decision, as well as Canada’s interest rate announcement and Bank of Canada monetary policy statement. Significant price volatility may occur during the news release.

Risk Disclaimer: Given ongoing geopolitical tensions, all scenarios remain possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations