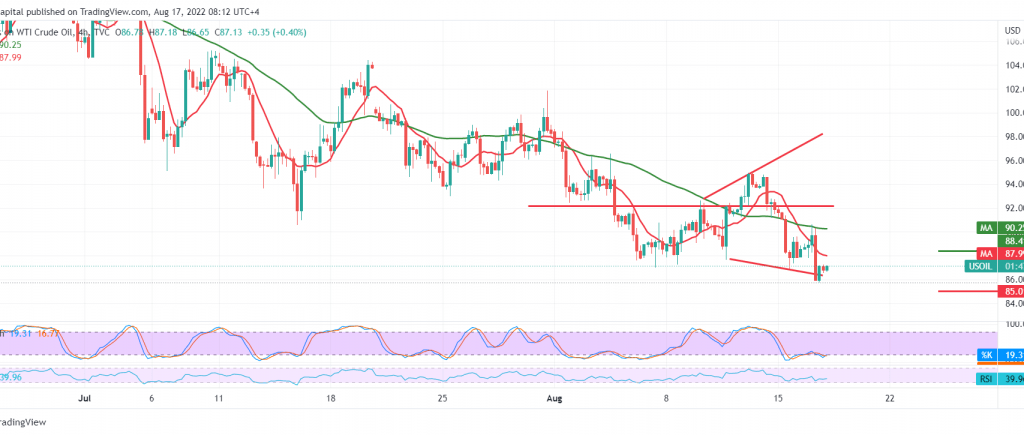

American crude oil achieved the first official target within the expected bearish path at the price of 86.40, recording as low as $85.75 per barrel.

Technically, the daily trend is still bearish, with the continuation of the negative pressure of the simple moving averages, in addition to the price stability below the resistance level of 88.00 and, most importantly 88.35.

Resuming the decline is the most preferred scenario today, knowing that the reduction below 87.00 increases and accelerates the strength of the daily bearish trend, to be waiting for 85.00 initial price stations, with the target may extend later towards 84.50, and that depends on the price stability below the 88.35 resistance level.

From above, consolidation above the mentioned resistance can postpone the downside idea, and we may witness a temporary recovery to retest 89.90.

Note: The International Energy Agency’s oil inventories report is scheduled for release today, and we may witness high price volatility.

Note: UK inflation data, US retail sales data, and the results of the Federal Reserve meeting are due today, which are high-impact data; we may see high volatility in prices and all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations