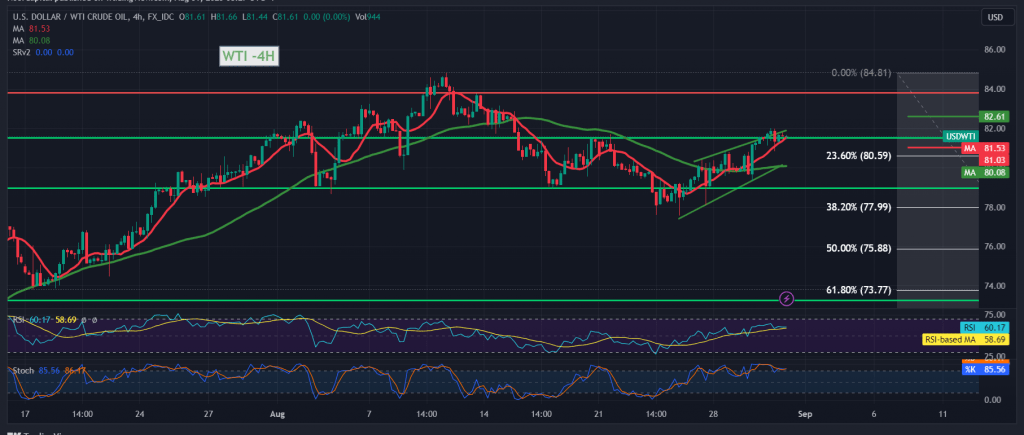

Quiet movements tending to the upside dominated the movements of US crude oil futures contracts within the desired upward path, approaching by a few points from the first official target of 82.30, only to record the highest, around $82.00 per barrel.

Technically, with a closer look at the 4-hour chart, the price has stabilized above the 81.00 level, and the 50-day simple moving average is still holding the price from below, with the stochastic indicator trying to obtain more bullish momentum.

We maintain our positive outlook, targeting 82.10/82.00 as a first target, noting that breaching it is a motivating factor that enhances the chances of continuing the upward trend to visit 82.60 and 83.20 as next official stations.

Trading stability below 81.00 with the closing of at least an hour candle can thwart the proposed scenario and lead oil prices to retest the 80.60 23.60% Fibonacci retracement as shown on the chart, before rising again.

Note: The risk level may be high.

Note: Today we are awaiting high-impact economic data issued by the American economy, “Personal Consumption Spending,” and we may witness high price fluctuation when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations