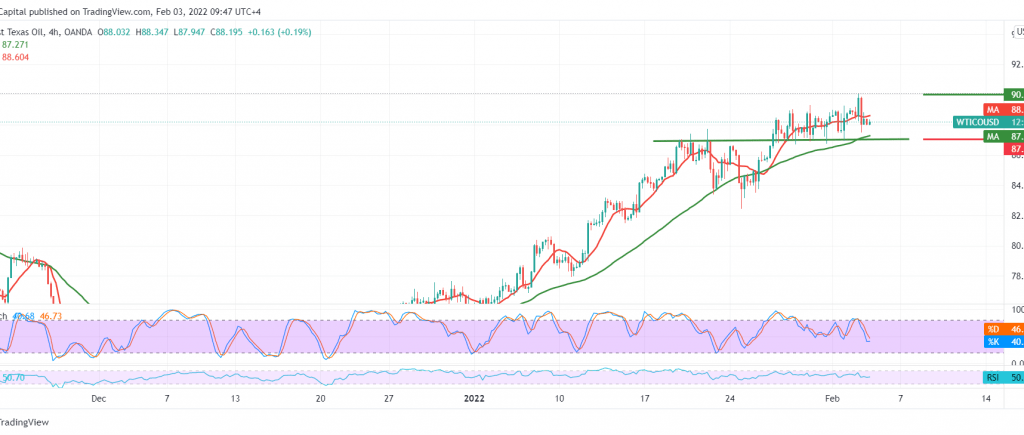

During the previous trading session, mixed trading tended to positively dominate the US crude oil futures prices, within a gradual rise towards the 90.00 level, recording the highest level at 89.70.

Technically, looking at the 4-hour chart, we find that stochastic attempts to obtain more bullish momentum, in contradiction with the negativity that started appearing on the RSI on the short time frames, in addition to the stability of the intraday trading below the 88.50 resistance level.

We prefer to monitor the price behavior during the day, noting that the confirmation of breaking 87.00 might lead the price to enter a strong bearish bias towards areas of 85.60, while crossing upwards to the resistance level 88.50 makes oil recover, heading towards 89.35 and 90.00 next price stations.

Note: the level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 86.75 | R1: 89.35 |

| S2: 85.60 | R2: 90.80 |

| S3: 84.10 | R3: 91.90 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations