Mixed movements dominated the prices of US crude oil futures contracts, moving in both upward and downward directions. As a reminder, we indicated during the previous report that we are waiting for a bearish tendency that aims to retest 82.00 and 81.70, explaining the importance of this level to the general trend in the short term, to start with an upward rebound, benefiting of the support above.

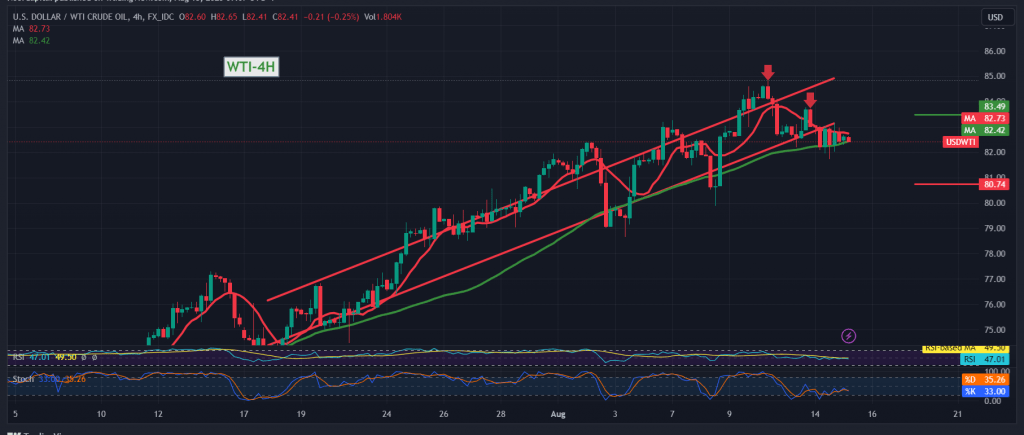

Technically, by looking closely at the 4-hour chart, we find the price stable below 83.50, achieving a clear breach of the mentioned level and still moving outside the boundaries of the bullish channel, in addition to the clear negative signs on stochastic, which continues to lose momentum gradually.

Therefore, we tend to be negative, but with caution, targeting a retest of 82.00, with a first target, and then 81.70. We must pay close attention if the mentioned level is touched, due to its relevance to the general trend in the short term, and breaking it forces oil prices to enter into a bearish technical correction, with a target of 80.70.

If the price succeeds in consolidating above 83.50, oil prices will return to the main bullish trend, with targets starting at 84.20 and 84.85 initially.

Note: Today we are awaiting high-impact economic data issued by the US economy “Retail Sales” “New York State Manufacturing Index” and from Canada, we await “Monthly Consumer Prices” and from England, we await “Change in Unemployment Claims” and we may witness high volatility in prices.

Note: the risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations