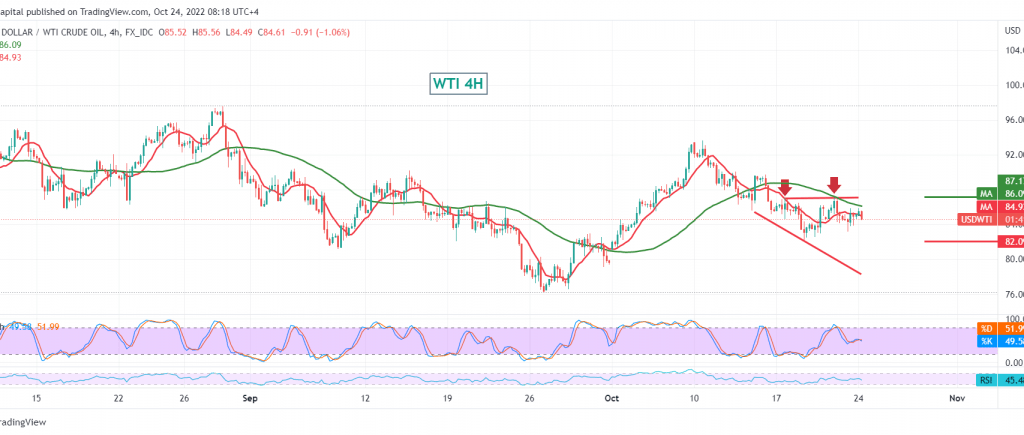

A downward trend dominated the movements of US crude oil futures prices after it gave up its recent gains that it achieved during last Thursday’s trading session to record as low as $83.17 per barrel.

The technical outlook today tends to the negative, relying on the stability of daily trading below the pivotal resistance located at 85.90 and the negativity of the 50-day moving average.

We are waiting for the confirmation of oil breaking the strong demand point 84.20, and this will facilitate the task required to visit 83.20 first target, and then 82.00 awaited next station.

From above, the stability of trading above 85.90 can completely thwart the above-suggested scenario, and oil will recover temporarily, targeting 87.20.

Note: The RSI is starting to send out warning signals.

Note: the risks are high and there are many data related to the energy markets that may make all scenarios likely.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations