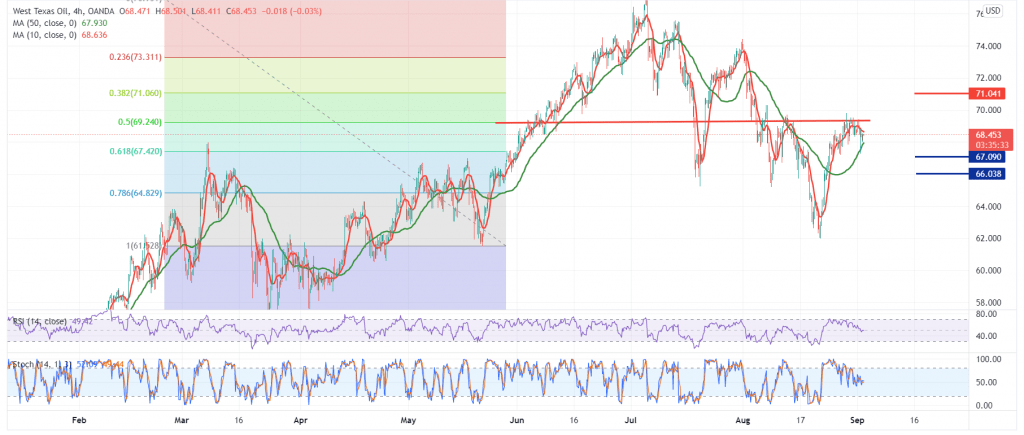

Mixed trading dominated the movements of crude oil during the previous trading session. We have warned of random movements after the OPEC meeting, explaining that breaking 68.00 will postpone the chances of a rise, and we may witness a retest of 67.50 and 67.00 before attempts to rise again. Oil touches the bearish target at 67.10.

Technically, and by looking at the 60-minute chart, we find the 50-day moving average that started to pressure the price from topside, and we see the intraday trades are stable below 68.80.

There is a possibility of a bearish bias in the coming hours, with a target of 67.10, considering that the confirmation of breaking the mentioned level will extend oil losses to 66.10 as the next official station.

Settling above the 69.25 resistance level, 50.0% Fib, serves as a turning point to complete the bullish path, with targets that start at 70.30 and extend towards 71.00.

| S1: 67.10 | R1: 69.30 |

| S2: 66.10 | R2: 70.30 |

| S3: 65.20 | R3: 71.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations