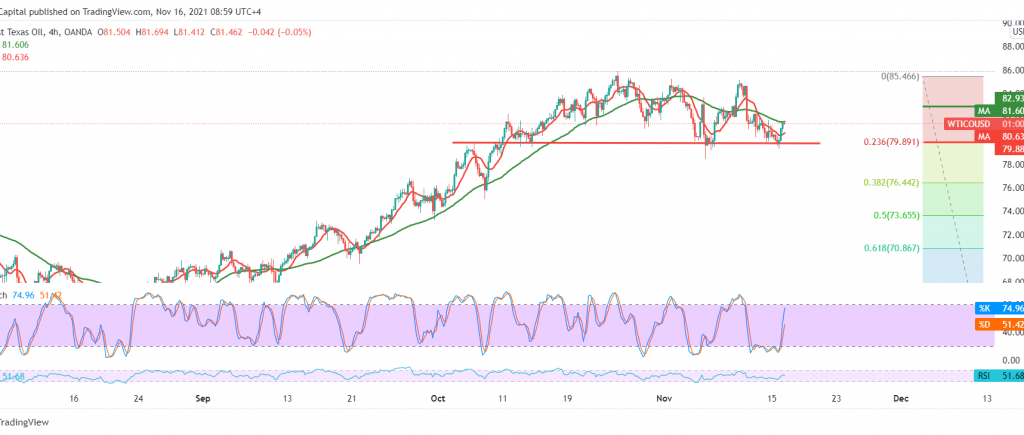

Negative trading dominated the movements of US crude oil futures prices within the expected bearish context during the previous analysis. Therefore, we relied on breaking the 79.80 level, recording 79.30 within moves to the downside.

Technically, the price built on support level published during the previous analysis at 79.80 and settled above, accompanied by the positive signals coming from the RSI on the short time frames, in addition to the temporary positive stimulus coming from the 50-day moving average.

Therefore, we may witness a bullish bias in the coming hours, provided that 81.60 is breached, targeting 82.20, and the intraday gains may extend to visit 82.80. However, it should be noted that the limited bullish bias does not contradict the daily bearish trend, with initial targets lie around 77.65 once we witness the breach of 79.90, 23.60% correction.

| S1: 79.80 | R1: 82.20 |

| S2: 78.45 | R2: 83.00 |

| S3: 77.65 | R3: 84.55 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations