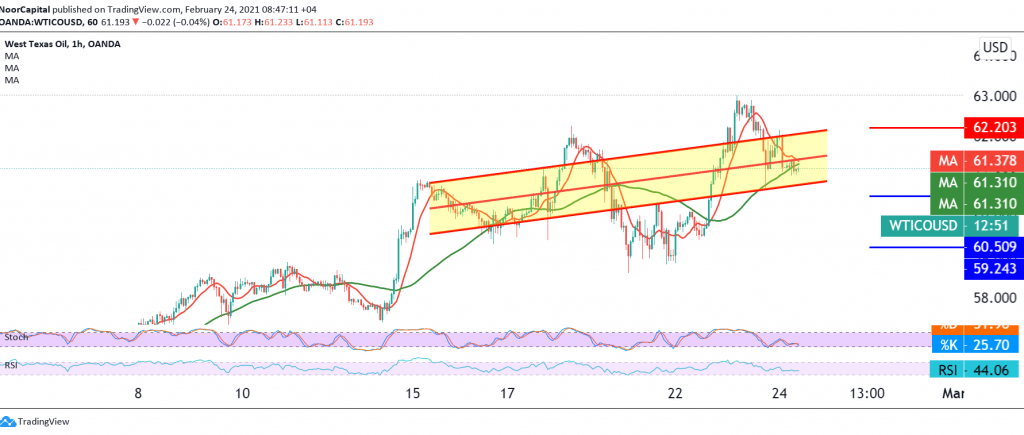

Mixed trades dominated the futures price of US crude oil after it found it difficult to overcome the psychological barrier of 63.00, as the current moves witnessed a stable bearish tendency below the resistance level 62.20.

Technically, we find that the 50-day moving average is pressing the price from below, and this coincides with the stability of the RSI indicator below the 50 midline.

Therefore, we may witness downside movements during the coming hours, targeting 60.60 and then 60.20 respectively, knowing that the confirmation of a break of 60.20 accelerates and confirms the strength of the daily bearish trend so that the way is directly open towards 59.30.

The bearish scenario requires stability below 62.20, and most importantly 62.50.

Note: The ternational Energy Agency crude oil inventories data due today and we may witness high prices volatility.

| S1: 60.20 | R1: 62.55 |

| S2: 59.30 | R2: 63.90 |

| S3: 57.95 | R3: 64.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations