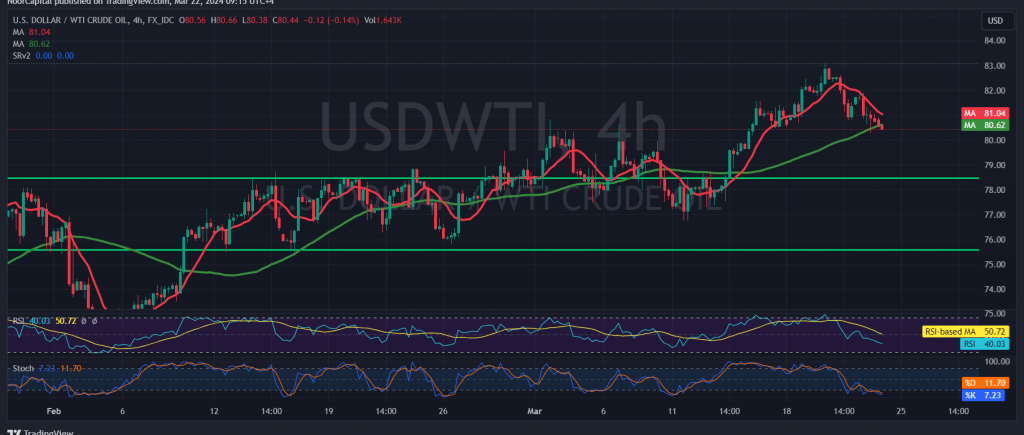

Mixed trading characterized the movement of US crude oil futures contracts, exhibiting both upward and downward movements and currently hovering near its lowest level at $80.45 per barrel.

From a technical standpoint, we lean towards a bearish bias in our trading outlook, albeit cautiously. This is supported by the beginning of a negative crossover of the simple moving averages, with the 50-day moving average exerting downward pressure on the price from above. Additionally, the relative strength index is signaling negativity.

With daily trading below the resistance level of $81.40, the bearish trend is expected to persist, albeit temporarily. The initial target is set at $79.90, and breaking below this level could pave the way for further declines towards $79.50.

On the upside, a return to stability in trading above $81.45 would negate the temporary bearish bias and set oil prices on an upward trajectory, with initial targets beginning at $82.45.

Warning: Today’s trading may be impacted by a speech from Jerome Powell, Governor of the Federal Reserve, potentially leading to increased price volatility.

Warning: Given ongoing geopolitical tensions, there is a high level of risk, which may result in heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations