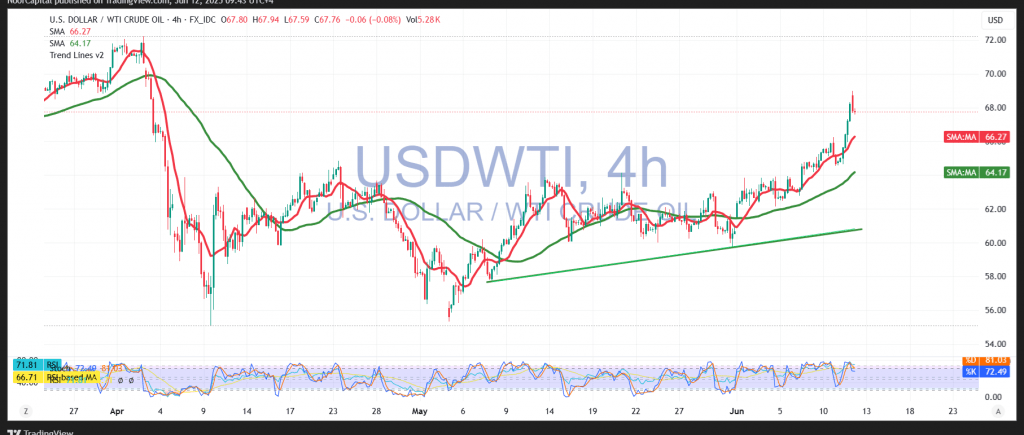

U.S. crude oil futures posted sharp gains in the previous session, reaching the official target of $66.85 and extending to a session high of $68.98 per barrel.

From a technical standpoint, intraday price action showed signs of bearish pressure, largely attributed to profit-taking after the strong rally. This coincides with negative signals from momentum indicators, suggesting overbought conditions in the short term. Nevertheless, the broader upward trend remains intact, supported by the continued bullish alignment of the simple moving averages.

As long as trading holds above $65.60—with at least an hourly candle close—the bullish scenario remains favored. A confirmed breakout above the $69.00 level would likely strengthen and accelerate the upward trajectory, with potential targets at $69.65 and $70.50. Should momentum persist, gains may extend further toward the $71.40 region.

However, a return to stable trading below $65.60 would weaken the bullish outlook and could trigger a deeper correction, with a possible decline toward the $62.75 support zone.

Warning: Investors should be alert ahead of today’s release of the U.S. monthly and annual Core Producer Price Index (PPI), a key inflation metric. The announcement may lead to sharp price movements across energy markets.

Risk Note: Volatility remains elevated amid ongoing global trade tensions, and all market scenarios should be considered.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations