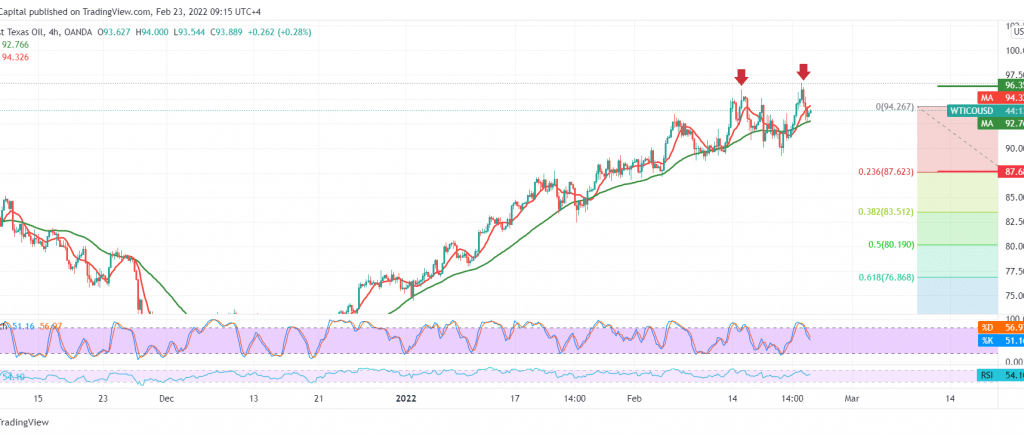

US crude oil futures prices achieved the official target at 94.40, recording its highest level during the last session’s trading at 94.90.

Technically, Oil prices found a pivotal resistance level around the psychological barrier of 95.00, which forced the price to form a quick negative attack to retest the 91.00 level. Looking at the 60-minute chart, we find the price is stable intraday below 92.80. We also find the beginning of negative signs appearing on the momentum indicator.

Therefore, we may witness a negative session, provided that we witness a clear and strong break of the 91.00 support level, and that may force the price to enter a bearish correction to 89.20. The correction targets extend towards 88.80 initially, as long as the price is stable below 92.75 and generally below 94.40.

Trading and price stability above the resistance level of 94.40 will stop the bearish corrective scenario and oil will recover within the official bullish track, heading towards 96.60.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 90.50 | R1: 94.40 |

| S2: 88.80 | R2: 96.60 |

| S3: 86.65 | R3: 98.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations