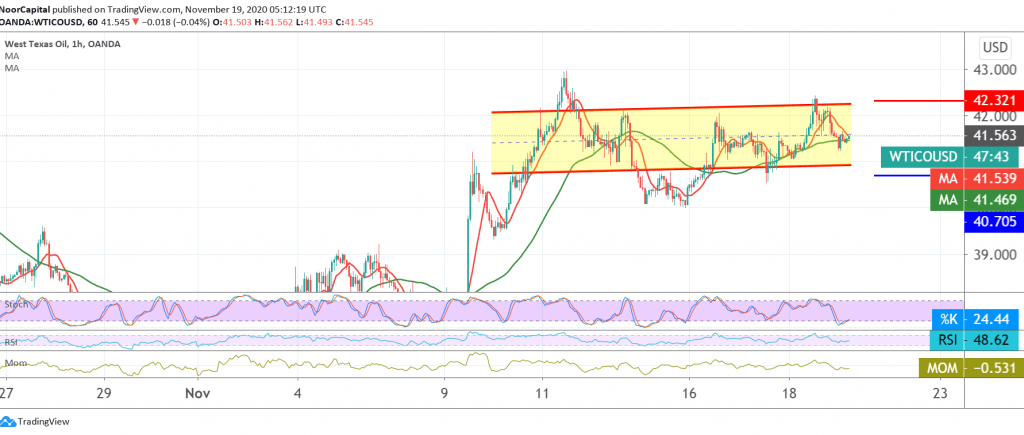

Positive trading dominated the movements of US crude oil futures, as we expected, surpassing the first target to be achieved at 42.10, to record a high of 42.43.

Technically, the current moves are witnessing a downward easing tendency due to the clear negative crossover signals on the stochastic, which coincide with the beginning of the negative signs appearing on the RSI indicator.

Therefore, we may witness a bearish bias during the coming hours, targeting a re-test of 40.90 / 40.80 support level before attempting to rise again.

A reminder that the activation of the suggested scenario depends on the price stabilizing below the resistance level of 42.30, knowing that its breach is a catalyst leading oil prices to resume the official bullish path, opening the way to a visit of 43.10.

Warning: The expected slight bearish bias does not coincide with the daily bullish trend.

| S1: 40.90 | R1: 42.30 |

| S2: 40.30 | R2: 43.05 |

| S3: 39.50 | R3: 43.65 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations