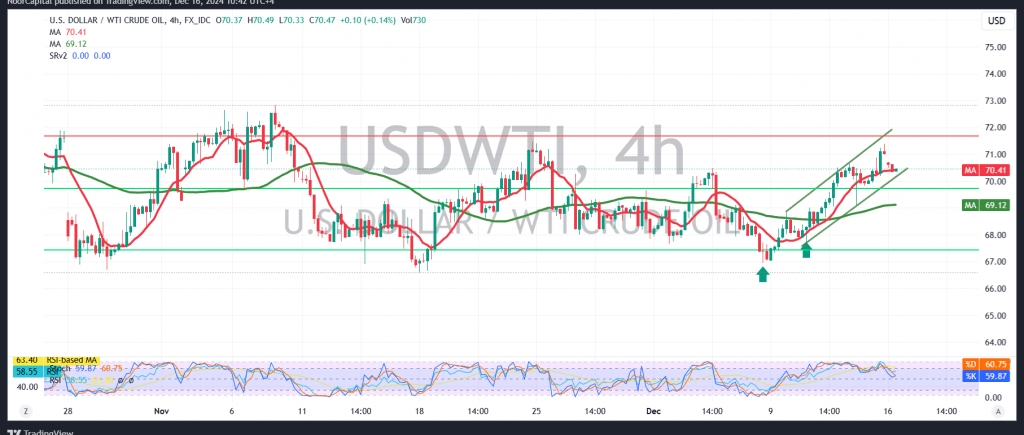

Mixed trading dominated the movements of US crude oil futures, with prices reaching the initial target highlighted in the previous technical report at 71.10, and recording a high of $71.38 per barrel.

From a technical perspective, the 240-minute chart indicates that prices are currently stabilizing above the minor support level of 69.75. The simple moving averages are also supporting the potential for the continuation of the upward trend.

With trading maintaining stability above 69.60, and more significantly above the primary support level of 68.60, the bullish trend remains the preferred scenario for the day. Targets are set at 71.25, and breaching this level could further boost the upward momentum, opening the path toward 71.85 and 72.10.

On the downside, a confirmed hourly candle close below 69.60 might subject prices to temporary negative pressure, possibly triggering a retest of the 68.65 support level before attempting another rebound.

Warning: The risk level is elevated and may not align with the expected return.

Warning: Amid ongoing geopolitical tensions, market conditions remain volatile, and all scenarios are possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations