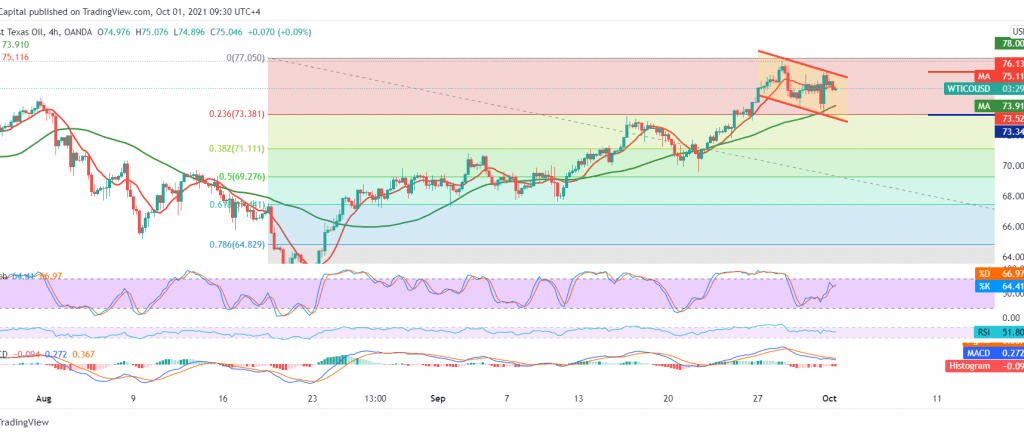

Mixed trading dominated US crude oil futures prices during the previous trading session, to find a strong resistance level around 76.00, which was able to limit the bullish trend.

Technically, we tend to be negative temporarily, depending on the beginning of forming a bearish technical structure, in addition to the negativity signs that started appearing on the stochastic indicator.

From here, we may witness a temporary bearish slope whose initial target is to retest 73.30 represented by the 23.60% Fibonacci correction as shown on the chart. trading stability below 76.00 is an important and necessary condition to activate the suggested bearish scenario and its breach will immediately stop the attempts to retreat and lead oil to the official bullish path with an initial target of 77.60.

| S1: 73.25 | R1: 76.20 |

| S2: 71.70 | R2: 77.60 |

| S3: 70.35 | R3: 79.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations