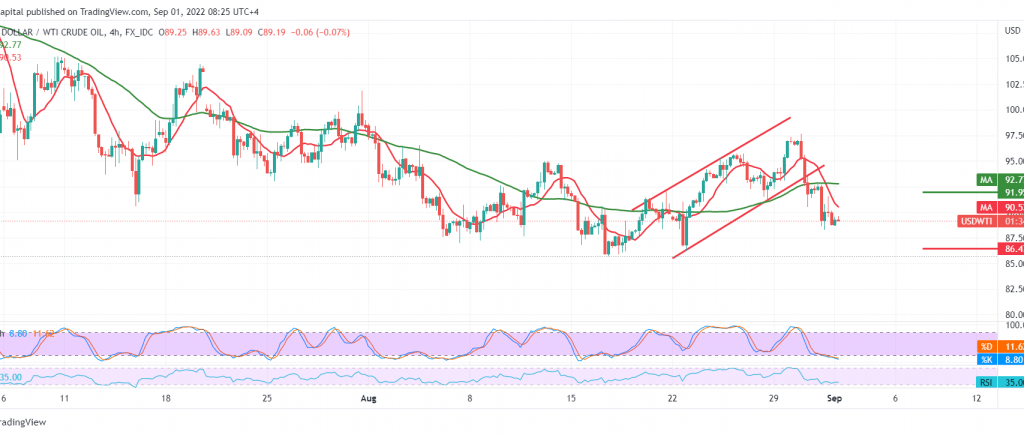

Significant losses witnessed the movements of US crude oil futures prices after it failed to maintain trading above the main support level of 93.50 to start a strong downward trend as we expected yesterday, surpassing the required target of 89.50 to record its lowest level at 88.23.

Technically, prices settled below the simple moving averages, in addition to the clear negative signs on the RSI in short time frames.

From here, the daily trading is below 90.60, and most importantly, 91.00, the idea of resuming the decline remains valid and effective, targeting 87.50, the first target, knowing that the official target for the current descending wave is around 86.50.

Consolidating again above 91.00 leads the price to recover temporarily to retest 91.90.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations