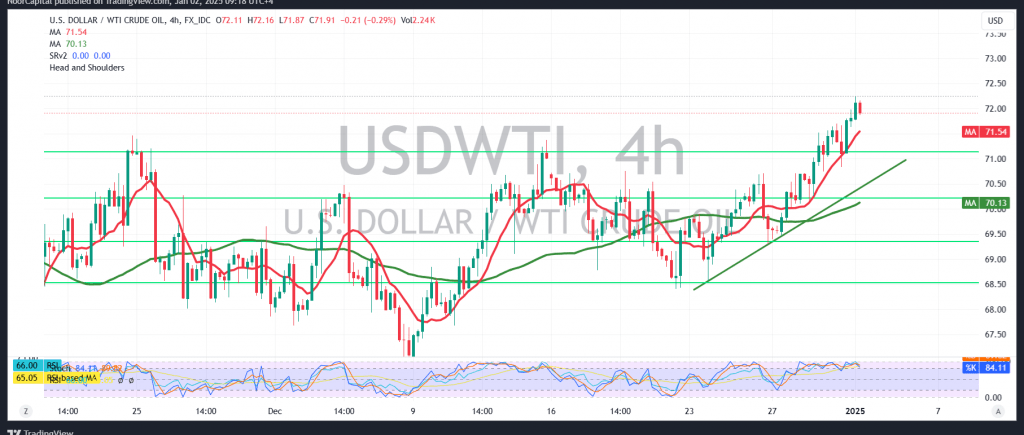

US crude oil futures maintained an upward trajectory in line with the positive outlook outlined in the previous report, successfully reaching the anticipated target of $72.20 and recording a peak of $72.25 per barrel.

Technical Outlook:

The bullish bias remains dominant, supported by positive momentum from the simple moving averages and clear upward signals from the Relative Strength Index (RSI), which remains above the 50 midline.

As long as daily trading remains stable above the strong support level at $71.20, the upward trend is expected to persist. A confirmed break above $72.15 would reinforce the bullish momentum, paving the way for further gains toward $72.50 and $73.00 as the next targets.

Downside Risks:

On the other hand, a confirmed break below $71.15 would invalidate the bullish scenario, potentially initiating a downward wave. In this case, the initial downside targets would be $70.60, followed by $70.35.

Risk Considerations:

Given the heightened geopolitical uncertainties, volatility remains elevated. Traders should remain vigilant, as all scenarios remain possible under current conditions.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations