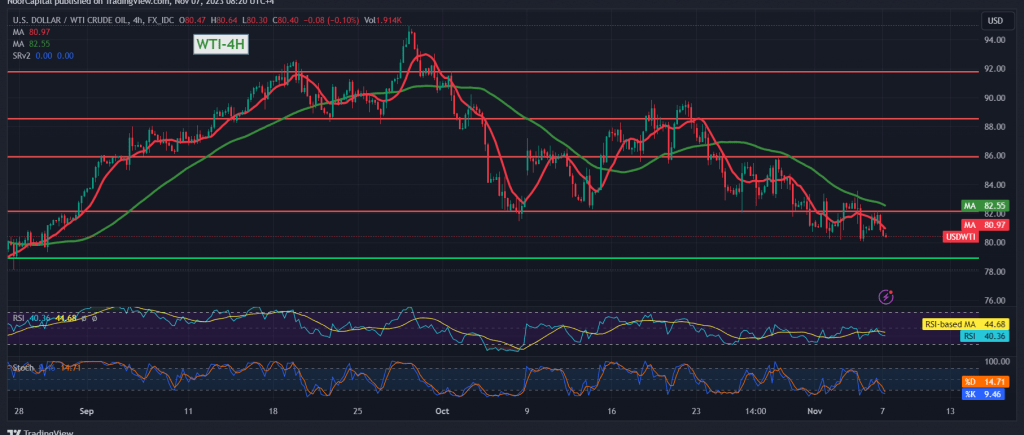

The US crude oil futures market faces a challenging scenario as prices grapple with pivotal resistance levels. Failure to close above the significant barrier at $82.00 has led oil prices into the expected downward trajectory, with early trading today witnessing a dip to as low as $80.40 per barrel.

Examining the technical aspects on the 4-hour timeframe, the 50-day simple moving average continues to pose a formidable obstacle to the price. Additionally, the breach of the $81.60 support level, now transformed into a resistance level due to role reversal dynamics, underscores the bearish sentiment prevailing in the market.

In this context, the bearish scenario remains the preferred outlook, targeting the initial support at $79.80. A further breakdown below this level would intensify the selling pressure, ushering in the next target at $79.15, with potential losses extending towards $78.00.

On the contrary, a breakthrough above the $81.60 resistance level could thwart the proposed bearish trajectory, initiating a recovery phase and setting the stage for a retest of $82.80 initially.

However, market participants are urged to exercise caution due to the heightened risks, amplified by ongoing geopolitical tensions. The potential for increased price volatility looms, making it imperative for traders to stay vigilant in navigating these challenging market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations