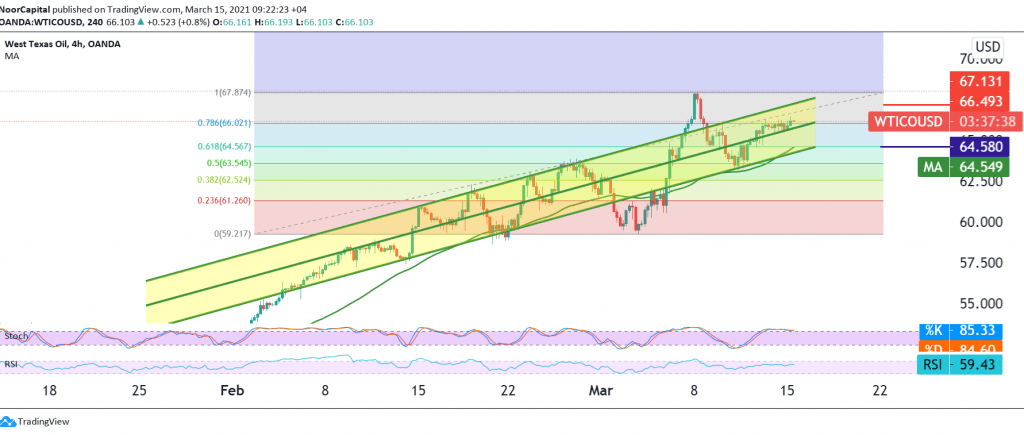

Positive trading dominated the futures price of US crude oil, as we expected touching the first target to be achieved during the previous analysis at a price of 66.45, recording its highest level of 66.40.

Technically, we tend to be positive, depending on the stability of trading above the support level of 65.50 and generally above 65.00, in addition to the price continuing to have bullish momentum coming from the RSI over short periods of time.

We maintain our positive outlook targeting 66.50 / 66.55 as a first target, knowing that breaching it is a catalyst that enhances the chances of a bullish move towards 67.00 / 67.10.

The activation of the bullish scenario depends on the price remaining above 65.00 today, and breaking it will delay the chances of an upside, and we may witness a re-test of 64.60, a correction of 61.80% before attempts to rise again.

| S1: 65.50 | R1: 66.55 |

| S2: 65.00 | R2: 67.00 |

| S3: 64.55 | R3: 57.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations