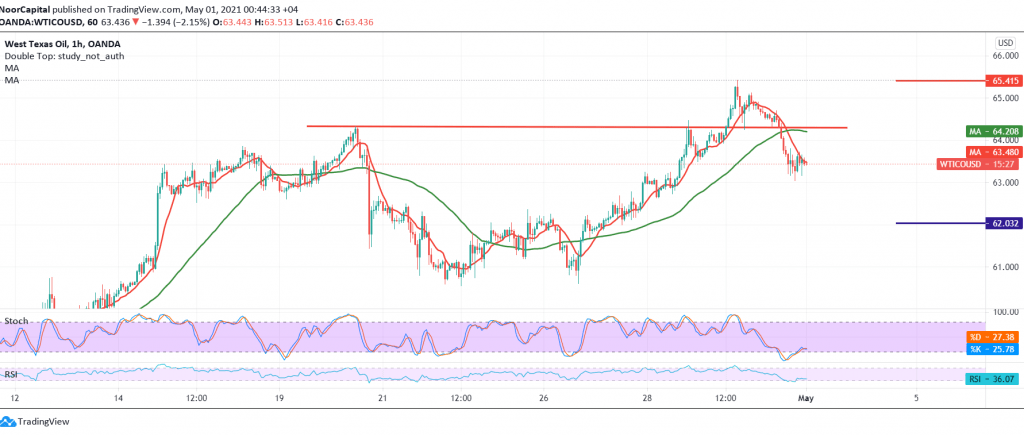

After several consecutive sessions of rising during which US crude oil futures prices achieved strong gains that touched 65.45 levels, to find that oil started with a negative bias at the end of last week’s trading, stabilizing below the resistance level of 64.00/64.30.

Technically, by looking at the 60-minute chart, we find that the RSI indicator began to gain bearish momentum on short time frames in addition to the negative pressure of the 50-day moving average.

Therefore, we believe that the bearish bias is likely today, targeting 62.75/62.70 a first target, and breaking it puts the price under negative pressure to complete the bearish bias with the second target of 62.00 and may extend later towards 61.60.

A reminder that the activation of the suggested bearish scenario requires the stability of daily trading below the resistance level of 64.45, and a breach of it could thwart the bearish scenario and lead oil to the official bullish path again towards 65.40 levels.

| S1: 62.75 | R1: 64.45 |

| S2: 62.00 | R2: 65.45 |

| S3: 61.10 | R3: 66.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations