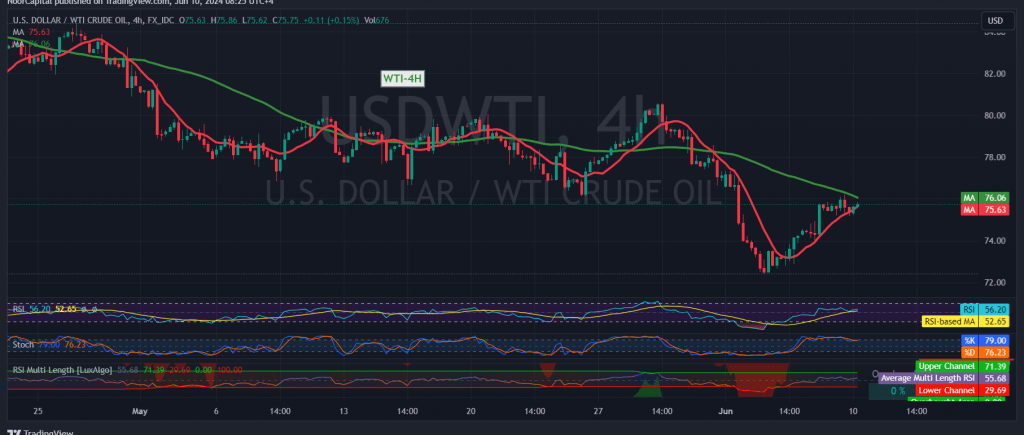

WTI crude oil futures experienced mixed trading, attempting to bounce back from recent lows by utilizing the 75.25 support level. Currently trading at $75.75 per barrel, the commodity faces a bearish outlook due to several technical factors.

The 50-day simple moving average continues to act as a strong resistance barrier, coinciding with the 76.20 resistance level. This confluence of resistance, coupled with the Stochastic oscillator losing bullish momentum on the 240-minute timeframe, suggests a potential continuation of the downward trend.

Traders should be prepared for possible further declines. A break below 75.25 could potentially lead to a drop towards 74.75, followed by 74.20.

However, a decisive move above 76.20 could invalidate the bearish scenario and trigger a temporary recovery. In this case, the price could retest 76.70 and even 77.20.

Overall, the technical outlook for WTI crude oil remains bearish in the short term, with downside risks outweighing the potential for a rebound. Traders should closely monitor the key support and resistance levels mentioned above and adjust their strategies accordingly.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations