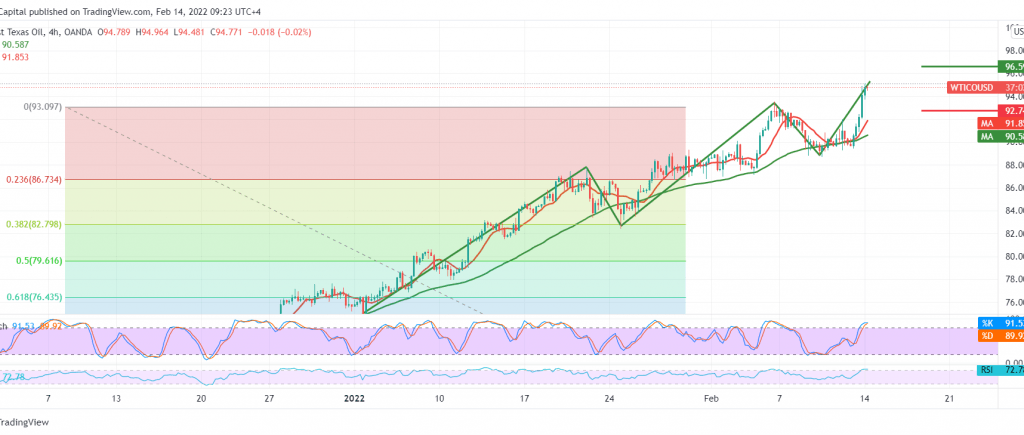

US crude oil futures prices jumped to the upside to achieve noticeable weekly gains, reaching its highest level during the last beer trading around 94.90.

Technically, the price pivoted above the previously breached resistance level near 92.60, accompanied by the positive motive for the 50-day moving average, which coincides with the continuation of the RSI providing positive signs that support the possibility of a rise.

Resuming the rise may be a valid and effective matter to visit 95.70/95.50, and it should be noted that consolidation above the latter may increase the strength of the bullish trend to visit 96.60 areas as long as the price is stable above 92.60.

The stability return below 92.60 may force the price to retest the support level of 90.90 before attempting to rise again.

Note: the level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 90.90 | R1: 96.60 |

| S2: 87.20 | R2: 98.60 |

| S3: 85.15 | R3: 102.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations