Mixed trades dominated the prices of US crude oil futures contracts as part of attempts to compensate for last week’s losses that exceeded 12%, to reach its highest level of 72.90.

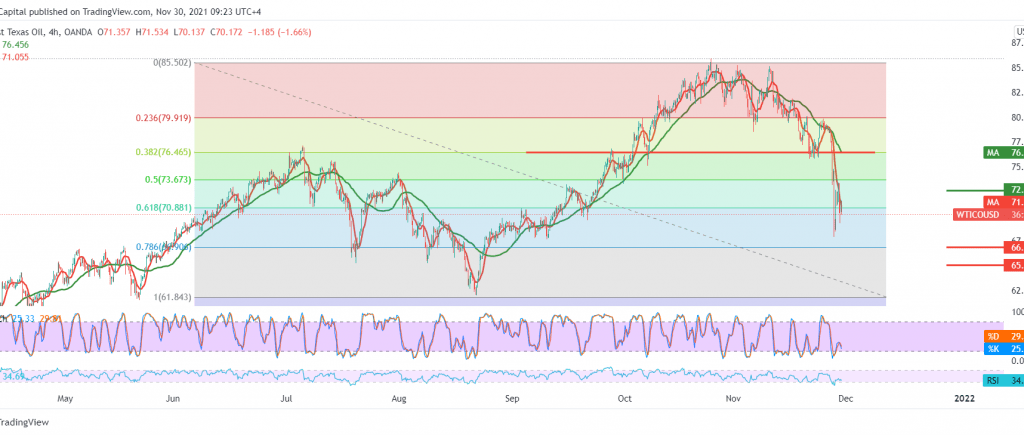

Technically, and on the 60-minute time frame, we notice a conflict between the technical signals. The RSI is gaining bullish momentum and the stability of trading above 68.50, which contradicts forming a 50-day moving average. This obstacle prevents attempts to compensate for losses. Therefore, we prefer to remain neutral until the daily trend becomes clearer, waiting for one of the following scenarios:

Activating short positions depends on the price moving below the 68.50 support level, and from here, oil extends its losses to touch low price areas around 66.65 and 65.00, respectively.

Activating long positions requires that we witness a clear and strong breach of the resistance level 72.50, and that may open the door to retest 73.00, a first target, and its gains may extend later to visit 74.00.

Note: The risk level is high

| S1: 68.50 | R1: 72.50 |

| S2: 66.65 | R2: 74.70 |

| S3: 64.45 | R3: 76.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations