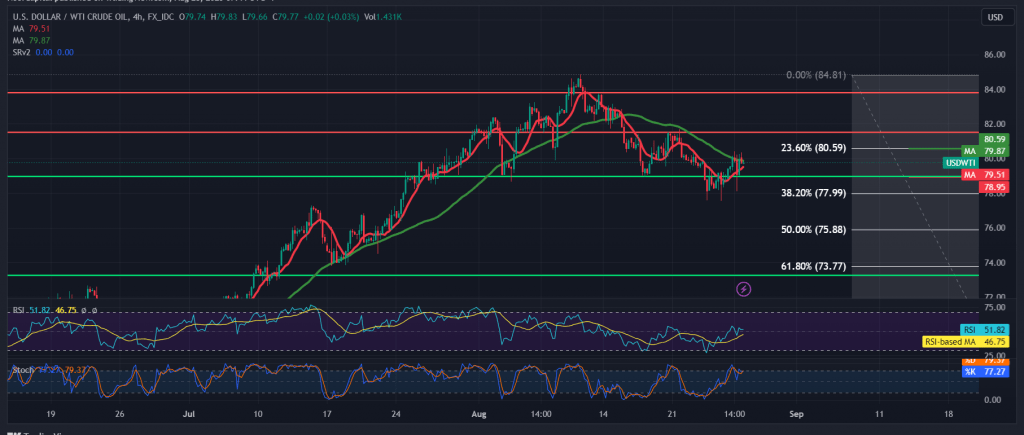

Mixed movements still control the prices of US crude oil futures contracts, to move in both upward and downward directions, recording a high of 80.45 before hitting a low of around $78.20 per barrel.

Technically, by looking at the 240-minute chart, the price is shifting around the 50-day simple moving average. We find negative signs starting to appear on the stochastic, and it is gradually losing bullish momentum.

We tend to be negative, but with caution, depending on trading remaining below the pivotal resistance 80.60/80.50, targeting 78.50. Care must be taken around this level, due to its importance to the general trend on the intraday basis, and breaking it would extend the losses, opening the door directly towards 77.25.

The price’s consolidation above 80.70 can thwart the bearish trend and lead oil prices to recover to retest 81.60 before starting the decline again.

Note: the risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations