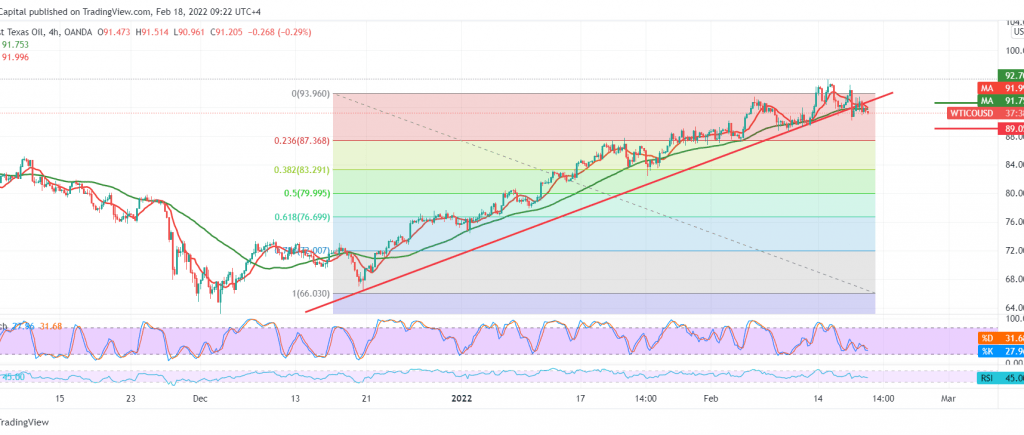

Mixed trades still dominate the US crude oil futures contracts within a bearish path seen in the previous trading session. The decline below the pivotal support floor at 91.30 renews the chances of the bearish tendency, targeting 90.00, recording a low of 90.77.

Technically, and by looking at the 60-minute chart, we notice that the RSI lost the bullish momentum, stable below the mid-line 50, in addition to breaking the support line of the ascending price channel at 92.30 and turning it into a resistance level.

Despite the technical factors that indicate the possibility of a drop, we prefer confirming the breach of 90.00 because that might force the price to start entering a descending correction wave, targeting 89.10 and 87.50, respectively, as long as the price is stable below 92.30.

The return of the trading stability above the mentioned level 92.30, and most importantly 92.70 leads oil to recover to visit 94.30s.

Note: The risk level is high and we may see random, erratic moves.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 90.10 | R1: 92.70 |

| S2: 89.10 | R2: 94.30 |

| S3: 87.50 | R3: 95.25 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations