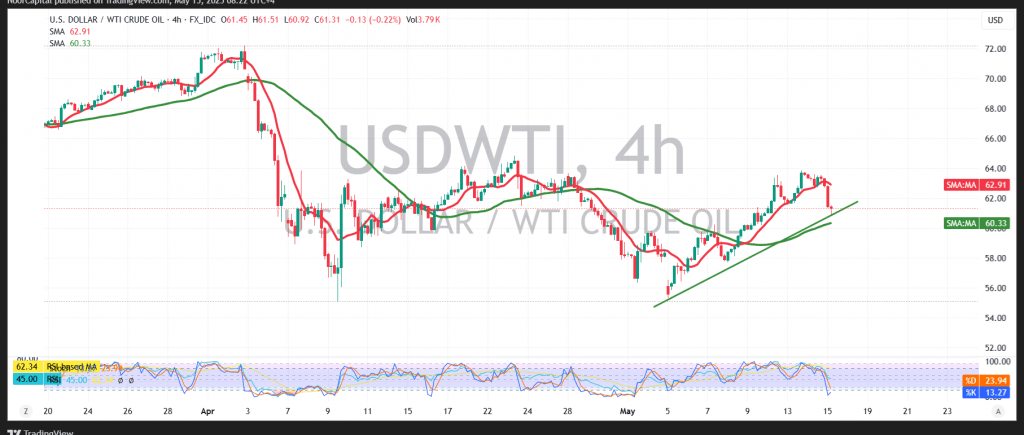

U.S. crude oil futures are currently trading with a bearish tone, following a retreat from the recent high of $63.64 per barrel recorded in the previous session.

Technically, the price is attempting to stabilize near the key support level at $61.20, suggesting the possibility of a short-term rebound. This potential recovery is supported by continued price action above the 50-day simple moving average and emerging positive signals from the Relative Strength Index (RSI), which is beginning to recover after entering oversold territory.

As long as the price holds above $61.20, a technical rebound appears likely, with the initial upside target at $62.50. A break above this level could extend gains toward $62.90.

However, a confirmed break below $61.20—validated by an hourly candle close—would shift the intraday bias back to the downside, exposing crude prices to additional selling pressure with a potential target of $60.30.

Key Event Risk Today:

High-impact U.S. economic releases could significantly influence price action, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

Traders should be prepared for heightened market volatility.

Risk Disclaimer: Amid persistent global trade tensions and sensitive economic conditions, the risk environment remains elevated. Market participants should exercise caution and prepare for a range of possible outcomes.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations