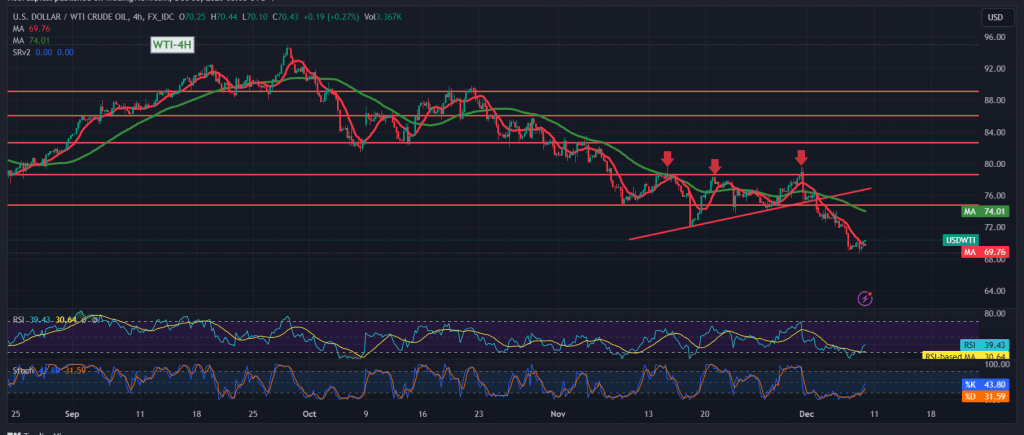

Mixed trading characterized the US crude oil futures contracts in the previous session, ultimately registering a low at $68.83 per barrel.

From a technical standpoint, the $68.80 level effectively mitigated the bearish inclination, prompting a rebound in oil prices. Presently, movements exhibit stability above the psychological barrier of $70.00. A closer examination of the 4-hour timeframe chart reveals positive signals on the 14-day momentum indicator, striving to propel the price to new short-term highs. Intraday trading maintains stability above $69.30.

In the upcoming hours, we might observe limited upward endeavours with the objective of retesting $70.95 and $71.40 before a potential resumption of the decline. It’s crucial to note that the bullish tendency does not necessarily negate the underlying bearish directional movement, which sets its sights on targets situated around $67.70 and $67.10 following a breach of $68.70.

Several warnings merit consideration: Firstly, the risk level remains elevated. Secondly, today’s anticipation of high-impact economic data from the American economy, specifically NFP jobs data, average wages, and unemployment rates, may lead to substantial price fluctuations during the news release. Lastly, persistent geopolitical tensions contribute to an environment of heightened price volatility, emphasizing the need for caution in navigating market movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations