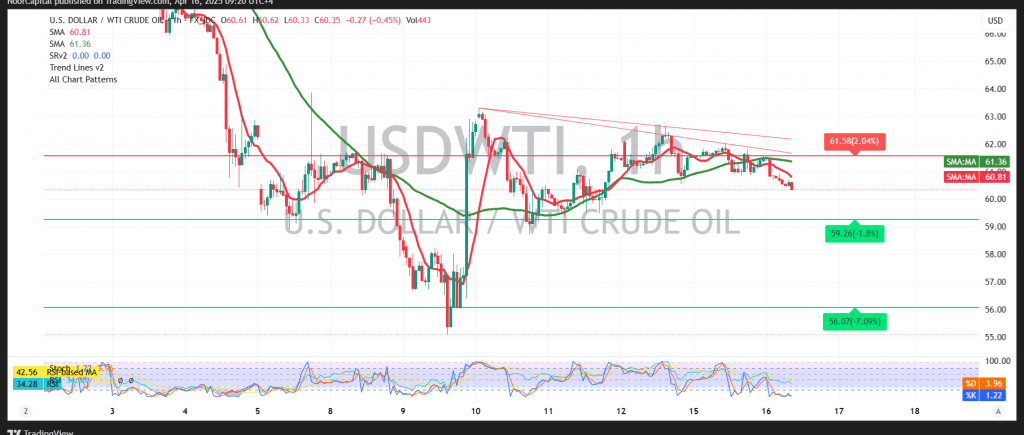

U.S. crude oil futures are facing strong resistance near the $61.60 level, which has exerted downward pressure on prices. As a result, oil has retreated and is currently trading around $60.50 per barrel.

From a technical perspective, the 50-period simple moving average—hovering near the $61.50 zone—is acting as a firm resistance level, reinforcing bearish sentiment. Additionally, the Relative Strength Index (RSI) is beginning to generate short-term negative signals, further supporting the possibility of a bearish move.

If the current pressure persists, a decline toward the psychological support at $60.00 appears likely. A confirmed break below this level could accelerate losses, potentially pushing the price down toward $59.50 in the near term.

Conversely, a return to stable trading above the key resistance at $61.60 would invalidate the bearish outlook and suggest a renewed attempt to regain upward momentum. In such a scenario, upside targets would be set at $62.00 and $62.50, respectively.

Key Event Risk Today:

High-impact economic data releases could significantly influence oil prices, including:

- United States: Retail Sales figures and a speech by a Federal Reserve Governor

- Canada: Bank of Canada interest rate decision, monetary policy report, and Governor’s press conference

These events may trigger notable volatility in crude oil and related markets.

Risk Disclaimer: In light of ongoing global trade tensions and central bank policy developments, market risk remains elevated. Traders should remain cautious and prepared for a range of potential outcomes.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations