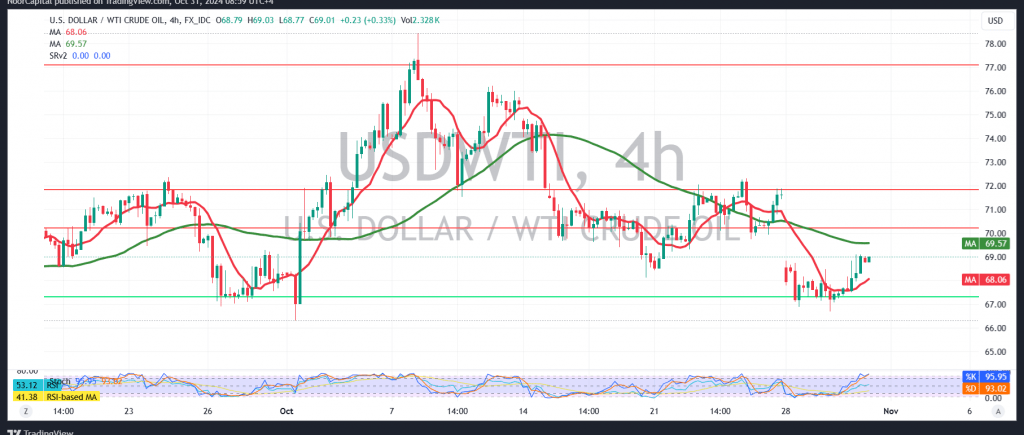

US crude oil futures saw a positive rebound, recovering from a low of $67.31 per barrel in the previous session.

Technical Analysis:

- Breaching the resistance level of $68.60 has provided support for further gains. The 240-minute chart also shows the Relative Strength Index gaining positive signals, reinforcing the upward outlook.

- If daily trading remains above $68.60, the upward trend is expected to continue, initially targeting $69.60. Breaching this level may further drive prices toward $70.25 and possibly extend to $71.40.

- Downside Risks: If oil prices fall back below $68.60, they could face renewed pressure, with a potential decline targeting $66.65.

Warnings:

The risk level is high due to ongoing geopolitical tensions, and multiple scenarios remain plausible.

High-impact economic data from the US, including Core PCE Prices, Unemployment Benefits, and the Employment Cost Index, may introduce significant price volatility upon release.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations