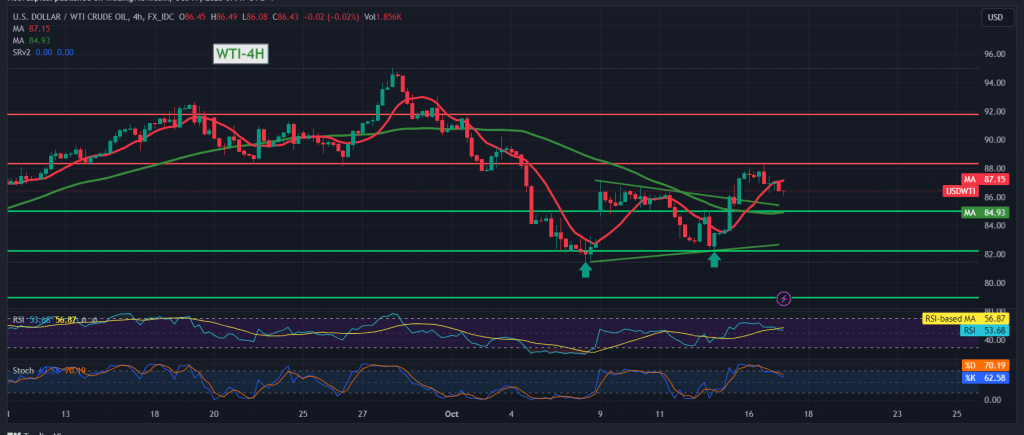

Mixed trading without a clear direction dominated US crude oil futures prices at the opening of this week’s trading, finding a solid resistance level around 88.30, which forced it to retest 86.20.

Technically, by looking at the 240-minute time frame chart, the 50-day simple moving average supports the possibility of resuming the rise, accompanied by intraday stability above the 85.65 support level.

With trading remaining above the mentioned support level, there may be an upward trend, provided we witness the price consolidation above 87.20. This motivating factor enhances the chances of a rise to visit 87.80, the first target, and the gains will extend later as we wait for 89.10 and 89.90, the next official stations.

Below 85.65 will immediately stop the upward trend, and we will rapidly decline towards 84.85 and 83.50.

Note: Today, we are awaiting high-impact economic data in the US, retail sales index and the annual core consumer price index from Canada, and we may witness high volatility at the time of the news release.

Note: The level of risk may be high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations