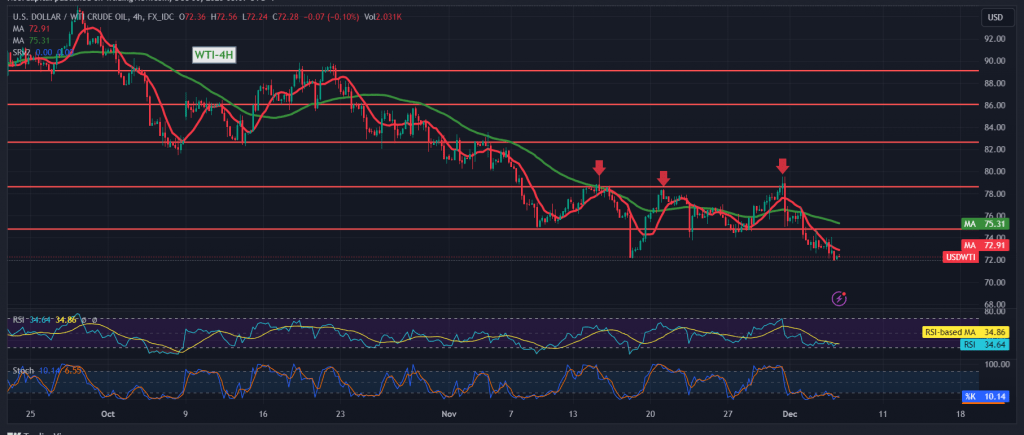

In line with our expectations, the futures contracts for American crude oil experienced a downward trajectory, successfully reaching the initial target of $72.60 and hitting the designated station at $72.15. The lowest point was recorded at $72.00 per barrel.

A meticulous examination of the 4-hour chart reveals that the price is contending with persistent negative pressure from the simple moving averages. These averages continue to align with the daily descent of prices, reinforced by evident negative signals on the 14-day momentum indicator.

Today’s trading session is anticipated to maintain the prevailing downward trend, contingent on intraday stability below the psychological resistance barrier of $73.00. A breach below $72.00 is deemed significant, amplifying the strength and acceleration of the downward trend. Our projections include a target of $71.50, followed by $70.70 as the subsequent milestone.

Reversing the scenario is contingent upon the return of trading stability above $73.00, confirmed by the hourly candle closing. Such a development would postpone the anticipated downward trajectory, potentially leading to a retest of $73.55 and $74.20 before the next price destination is determined.

Investors are urged to exercise caution, given the heightened risk level associated with today’s economic data releases, particularly the “change in private non-agricultural sector jobs” from Canada. The interest statement and rate decision from the Bank of Canada, coupled with the press talk by the Governor of the Bank of England, may induce substantial price fluctuations.

Moreover, the market is marked by geopolitical tensions, adding another layer of risk and the potential for increased price volatility. Traders are advised to remain informed, exercise prudence, and adapt strategies to navigate these uncertain market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations