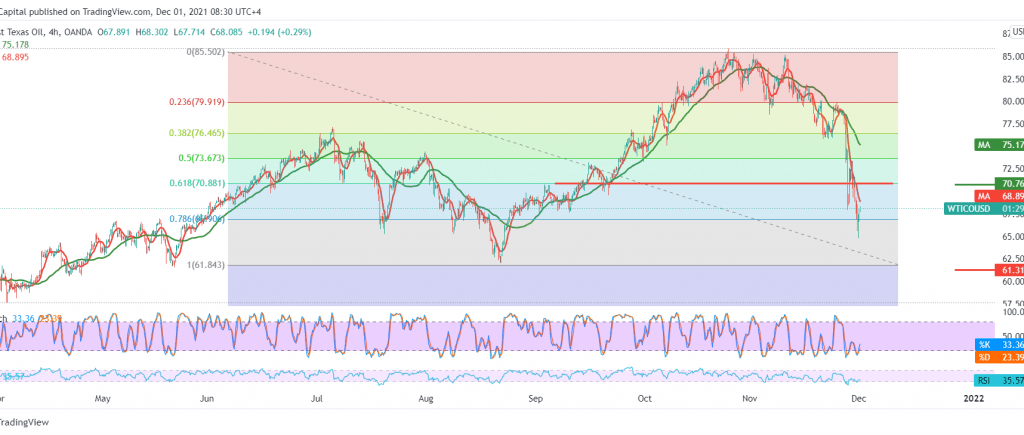

US crude oil prices incurred noticeable losses yesterday within the bearish trend published during the last report, in which we relied on breaking 68.50, explaining that will open the door to visit 65.00, to record a low at 64.45.

Technically, the current moves are witnessing a temporary bullish bias, based on the 14-day momentum indicator providing positive signals, in addition to stabilizing the intraday trading above 66.40, but with the short-term moving average outpacing the long-term moving average as shown on the 4-hour chart with negativity stochastic.

Therefore, the bearish scenario will remain valid and effective, knowing that declining below the support floor 64.5 increases the bearish trend’s strength, waiting for the next 61.40 price stations whose targets may extend later towards the 60.00 buying area.

As we mentioned above, maintaining negative stability requires the price to remain below the resistance level of 70.80, correction of 61.80%, because its breach will postpone the downside, and we are witnessing intraday attempts to recover, targeting 71.40 and 73.30.

Note: The risk level is high.

| S1: 64.50 | R1: 70.70 |

| S2: 61.35 | R2: 73.75 |

| S3: 58.30 | R3: 76.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations