Mixed trading dominated the futures prices of American crude oil during the previous trading session, touching the first bearish correction target, as we expected at 75.55, recording the lowest price of 74.95, resuming the bullish rebound strongly, benefiting remarkably from the psychological support level of 75.00.

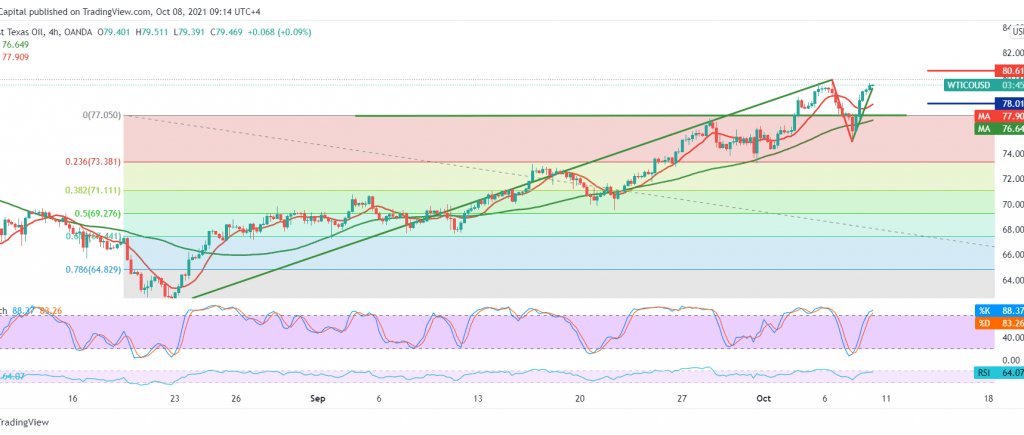

The current oil movements are witnessing stability around its highest level during the early trading of the current session at the price of 79.36. With a careful look at the 240-minutes chart, we find the simple moving averages holding the price from above, which comes in conjunction with the clear positive signs on the RSI and its stability above the line middle 50.

Therefore, the bullish bias is more likely today, targeting 80.50/80.40 as a first target, and its breach is a catalyst that contributes to consolidating the gains to visit 80.90 initially.

Activating the bullish scenario suggested above depends on the stability of trading above the 78.00 support level, the return of trading stability, and the price stability below the mentioned level, capable of thwarting the recovery of the bullish trend and leading oil to trade negatively towards 76.30.

Note: the level of risk is high.

| S1: 76.35 | R1: 80.90 |

| S2: 73.40 | R2: 82.45 |

| S3: 71.85 | R3: 85.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations