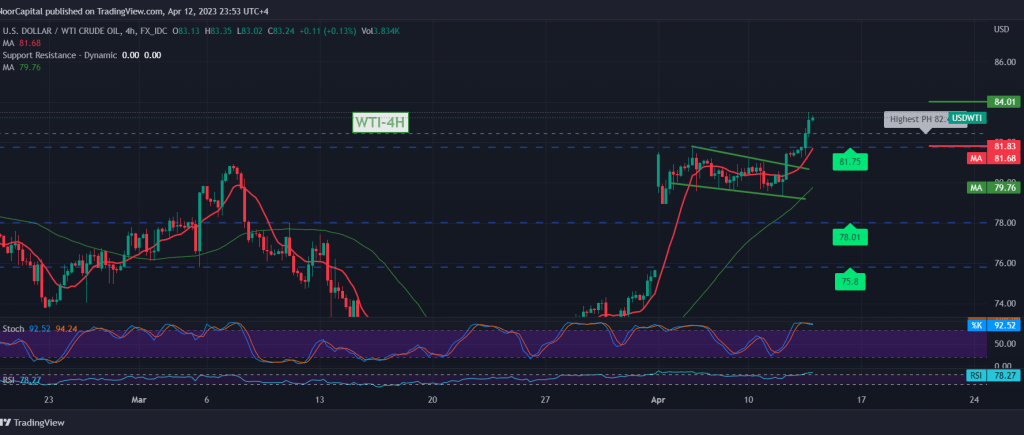

US crude oil futures prices jumped, continuing to achieve gains during the expected wave of rise during the previous analysis, touching the official target station at 83.20, recording its highest level of $83.50 per barrel.

Technically, by looking at the 240-minute chart, we find that oil prices succeeded in achieving a clear breach of the 81.70 resistance level, which in turn turned into a support level, accompanied by the positive impulse of the simple moving averages, in addition to the signs of bullish momentum on the short time frames.

Therefore, we maintain our positive expectations, knowing that the upside move and consolidation above 83.50 extend oil’s gains to visit 84.00 first target. The gains may extend later towards 84.80 if trading remains stable above 81.70.

Note: Today we are awaiting high-impact economic data issued by the US economy, “Producer Price Index, Unemployment Claims” and “Gross Domestic Product from the United Kingdom” and the speech of the Governor of the “Bank of Canada”, and we may witness a high fluctuation in prices at the time of the news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations