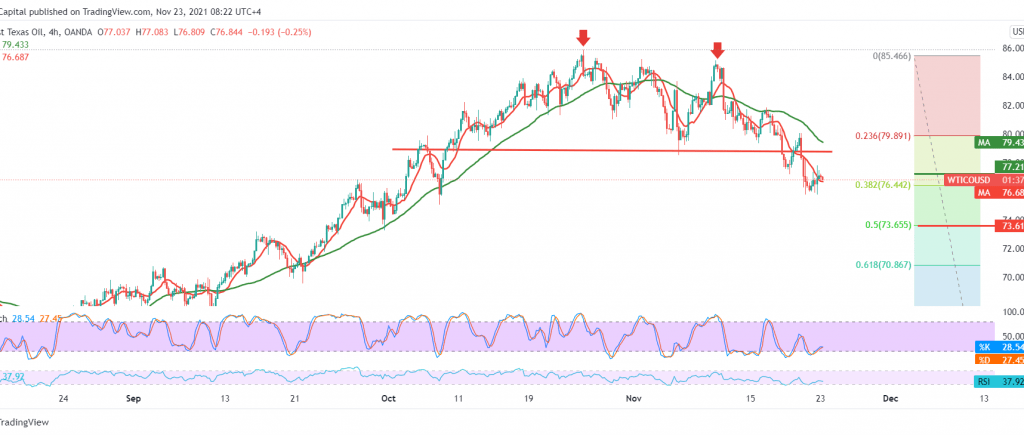

US crude oil futures prices are hovering around a critical resistance level at 76.40 that it has been unable to breach until now, maintaining negative stability.

Technically, activating the bearish scenario is still valid and effective, with the decline accelerating due to gaining strong bearish momentum signals, coinciding with the short-term moving average surpassing the long-term moving average.

Therefore, we maintain our negative outlook to target the price point around 75.10, a first target, and losses may extend to visit the long position around 73.65, 50.0% Fibonacci correction.

Remember that the stability of trading below the previously broken support-into-resistance at 77.20 is an important condition to maintain the bearish bias, and breaching the mentioned level will immediately stop the bearish scenario suggested above, and oil will recover to retest 78.30.

Note: the level of risk is high.

| S1: 75.10 | R1: 77.20 |

| S2: 74.10 | R2: 78.15 |

| S3: 73.20 | R3: 79.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations