WTI Crude Oil Prices Set for Further Gains, but Caution Advised

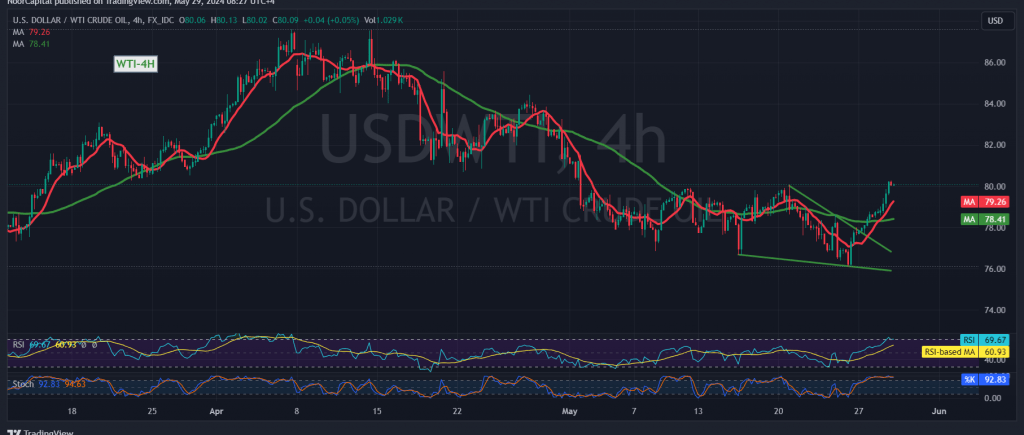

WTI crude oil futures prices are on a clear upward trajectory, having recently surpassed the targeted levels of 79.30 and 79.70 and approaching the key psychological level of 80.50. The commodity reached an intraday high of $80.28 per barrel, signaling strong bullish momentum.

Technical indicators support the continuation of this upward movement. The positive intersection of the simple moving averages, coupled with clear bullish signals from the 14-day momentum indicator, reinforces the potential for further gains.

As long as trading remains above the crucial 79.00 support level, the bullish scenario remains intact. The next potential targets for the upward move are 80.75 and 81.40.

However, traders should remain cautious as a decisive move below 79.00 could disrupt the bullish momentum and trigger a temporary correction. In this scenario, the price could retest the 78.00 level before attempting another upward move.

It’s important to note that the current geopolitical landscape poses significant risks, which could lead to heightened volatility and unexpected price swings. Traders are advised to exercise prudence and closely monitor market developments.

In summary, the technical outlook for WTI crude oil remains bullish, with further gains expected as long as the 79.00 support level holds. However, the potential for increased volatility due to geopolitical tensions necessitates a cautious approach. Traders should closely monitor price action and adjust their strategies accordingly.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations