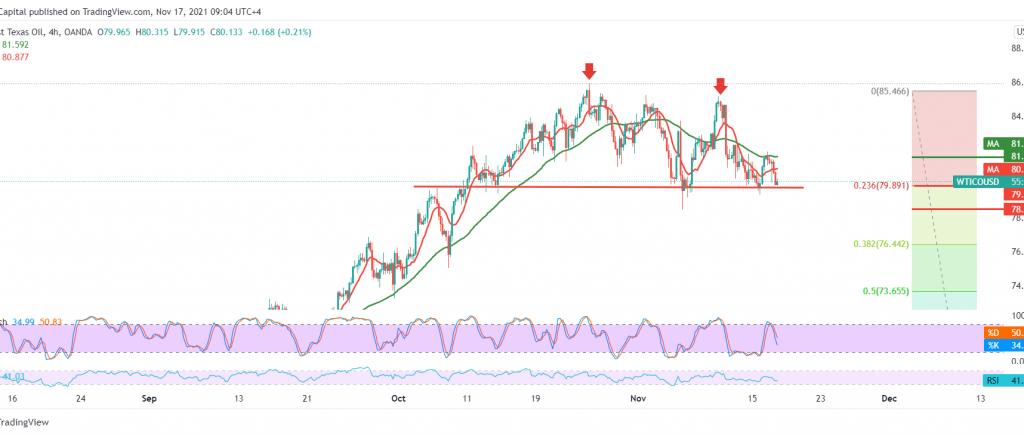

Mixed trading dominated the movements of the US crude oil futures contracts during the previous trading session within attempts to stabilize above the strong demand area at 79.90.

Technically, by looking at the 240-minute chart, we find the price is stable above 79.90, the support represented by the 23.60% Fibonacci correction, and we find the 50-day moving average pressing the price from above, in addition to the beginning of negative signals coming from the RSI.

We tend to be negative, but with caution, and we prefer to confirm breaking 79.90, which increases the possibility of touching the first 78.65 first target and then 77.40 waiting for the next station.

Stability below the extended resistance level 81.60/81.30 is essential to maintaining the aforementioned bearish context. Its breach will lead oil prices to rise during the session, with a target of 82.40.

| S1: 79.35 | R1: 81.30 |

| S2: 78.65 | R2: 82.50 |

| S3: 77.40 | R3: 83.25 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations