Mixed trading dominated the US crude oil futures prices during the previous trading session, under the influence of some statements regarding the expected production cut during the OPEC meeting tomorrow.

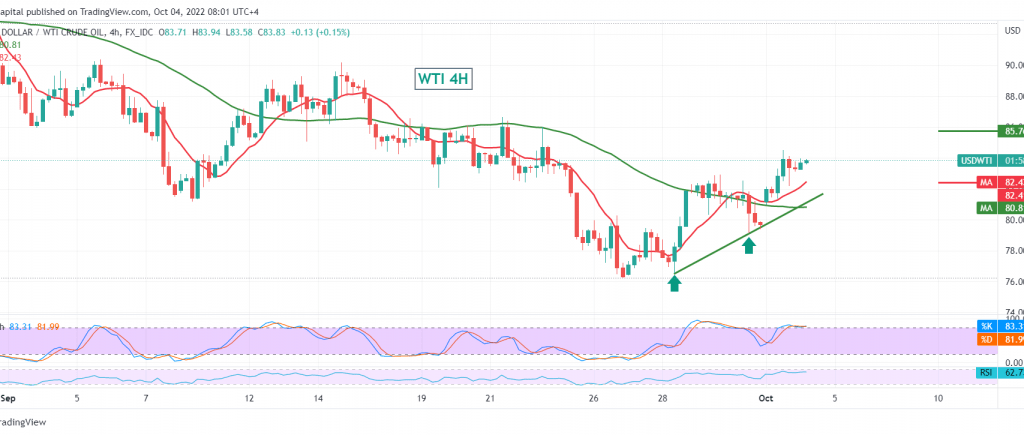

Technically, the current oil movements are witnessing intraday stability above 82.40 accompanied by the positive motive of the 50-day simple moving average, as we find the RSI defending the daily bullish trend.

Therefore, the possibility of continuing the rise is still valid, targeting 85.20/85.00 first target. Its breach is a catalyst that enhances the chances of touching 85.70, an expected next station, whose targets may extend later towards 86.30.

The decline below 82.40 postpones the chances of rising but does not cancel it, and we may witness a bearish slope that aims to retest 80.90 before attempts to rise again.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations