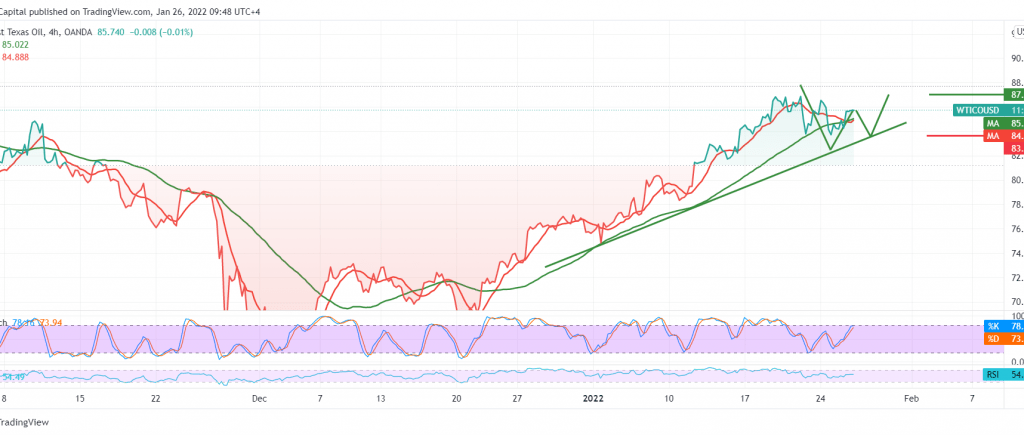

We adhered to intraday neutrality during the previous report due to the conflicting technical signals, explaining that reactivating the buying positions depends on the return of the stability of trading above 84.80, which enhances the chances of touching 85.75 as oil recorded its highest level during the last trading session 85.70.

Technically, we are inclined to the positivity, relying on confirming the breach of the 84.00 resistance level, which is accompanied by oil getting positive signs from the 14-day momentum indicator and its stability above the mid-line 50.

Therefore, there is a possibility to continue rising to target 86.20, considering that the breach of the mentioned level increases the strength of the bullish trend, opening the way towards 87.00.

Trading stability below the 84.00 level, and most importantly 83.85, can thwart the proposed scenario, and oil prices will begin to decline, with a target of 81.80.

Note: Fed statement is due today and may cause high volatility.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 83.50 | R1: 86.25 |

| S2: 81.80 | R2: 87.30 |

| S3: 80.75 | R3: 88.95 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations